Retirement Ready is a practical goal that grows from daily choices rather than dramatic changes, and it aligns with smart retirement planning. The message here is simple: you do not need perfect timing or extensive wealth to start. You can begin with small, consistent steps that accumulate over years as your habit strengthens. This guide outlines straightforward finance plans that lead to a secure future and points you toward sensible investment strategies for retirement. It emphasizes practical actions such as setting clear goals, automating savings, choosing low-cost investments, and aligning income streams for later life, while inviting readers to start today with a simple, repeatable plan.

Another way to frame the same idea is retirement readiness in broader terms, emphasizing steady savings and disciplined income planning. This perspective centers on long-term financial security that supports a comfortable lifestyle as you age. Pension planning and Social Security strategy become integral elements within a holistic retirement framework. By pairing sensible budgeting with diversified, low-cost investments, you create resilient cash flow that adapts to changing needs. Using related concepts such as retirement income, retirement resilience, and sustainable withdrawal strategies helps readers connect ideas without overloading a single label.

Retirement Ready: Practical Steps for Retirement Planning and Savings

Retirement Ready grows from daily choices rather than dramatic changes. You don’t need perfect timing or vast wealth to begin. Start with clear goals, automate savings, choose low-cost investments, and align income streams for later life. This practical approach ties together retirement planning, retirement savings, and a simple mindset about investing to build security over time.

To become Retirement Ready, start with a baseline: list your monthly expenses, debts, savings, and current retirement accounts. This snapshot informs a realistic target and helps you maintain consistency. Small, regular contributions and the power of compounding often outperform trying to time markets. Separate short-term needs from long-term goals to keep retirement planning and savings on track, and lean on straightforward, low-cost investment strategies for retirement.

Smart Income and Tax-Efficient Planning: Social Security Strategy, Pension Planning, and Investment Strategies for Retirement

Income planning and the payout puzzle: Being Retirement Ready means more than saving; it means creating steady income in retirement. A thoughtful Social Security strategy can influence lifetime benefits, so consider when to claim based on health, family history, and income needs. Pension planning matters if you have a workplace pension, and some people explore annuities to lock in predictable income while balancing growth potential. This is a core component of retirement planning and income strategy.

Tax efficiency and account coordination: A key lever in retirement readiness is placing the right assets in the right accounts to minimize taxes on withdrawals. Use tax-advantaged accounts, coordinate with your overall income, and plan for required minimum distributions where applicable. Regularly review your situation to adjust the mix of accounts you rely on as income changes, ensuring alignment with retirement savings goals and investment strategies for retirement.

Frequently Asked Questions

What does it mean to be Retirement Ready, and how can retirement planning and retirement savings help me get there?

Being Retirement Ready means building a durable, long-term plan from small, consistent steps rather than chasing perfect timing. Start with a clear snapshot of your monthly expenses, debts, savings, and retirement accounts to set a realistic target. Then follow a simple retirement savings plan: automate contributions to your employer plan (such as a 401(k) or similar) and regularly fund an IRA or Roth IRA, using low-cost investments like broad index funds or target-date funds. Keep short-term needs separate from long-term goals and rebalance periodically as your life evolves. Include a basic Social Security strategy and, if available, straightforward pension planning to shape reliable income. The result is steady progress that compounds over time and keeps you Retirement Ready.

How should I coordinate pension planning, Social Security strategy, and investment strategies for retirement to stay Retirement Ready?

To stay Retirement Ready, coordinate pension planning, Social Security strategy, and investment strategies for retirement to create predictable income and growth. Decide when to claim Social Security based on health, family history, and income needs, and align that with any workplace pension. Use tax-advantaged accounts strategically, prioritize employer matches, and choose a simple, low-cost investment strategy—broad index funds or target-date funds—and rebalance periodically. Develop a withdrawal plan designed to last at least your expected lifetime while maintaining flexibility for health costs or family needs. Regular reviews keep you Retirement Ready as life changes.

| Topic | Key Point | Practical Tip |

|---|---|---|

| Baseline Assessment | Assess current finances (expenses, debts, savings, retirement accounts) to create a baseline and a realistic target. | Use the snapshot to guide retirement readiness. |

| Consistency over Intensity | Small, regular contributions over many years often beat trying to do more now; consistency compounds. | Focus on steady saving rather than perfection. |

| Emergency Fund & Automation | Build an emergency fund (3–6 months) and automate retirement contributions. | Automate to remove excuses and keep savings steady. |

| Low-Cost, Simple Investing | Favor broad-based index funds or target date funds; diversify and rebalance periodically. | Long-term habit beats chasing trends. |

| Income Planning & Withdrawals | Plan Social Security, pensions, annuities; design a withdrawal plan that lasts a lifetime. | Balance guaranteed income with growth; avoid aggressive withdrawals. |

| Tax Efficiency | Coordinate tax-advantaged accounts with income; plan withdrawals to minimize taxes; consider RMDs. | Review annually; keep tax planning separate from investments when possible. |

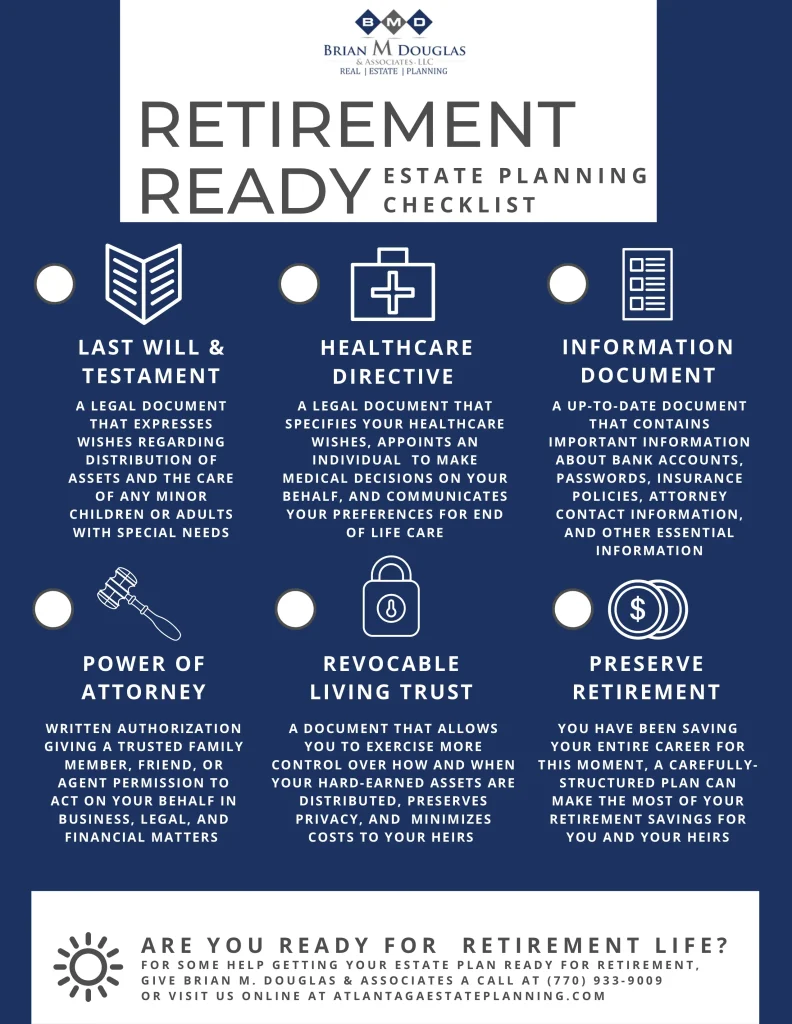

| Health, Protection & Legacy | Plan for health care, long-term care, and estate planning (will, POA, beneficiaries). | Protect assets and ensure smooth transfer to heirs. |

| Practical Steps Today | Define goals; build emergency fund; maximize employer match; automate; adjust tax-advantaged accounts; simple investments; plan income; health planning; update will/POA. | Follow the checklist to move from awareness to action. |

| Mindset | Consistency, patience, and a long-term focus; resilience through market volatility. | Keep the strategy simple to maintain momentum. |

Summary

Retirement Ready is within reach for most people when they commit to simple, repeatable actions. Start with a clear assessment of your finances, then build a dependable savings plan and a low-cost investing approach. Coordinate income options in retirement by considering when to claim Social Security, how a pension fits, and how withdrawals can last a lifetime. Protect health costs and establish essential legacy plans, such as a will and powers of attorney, to reduce uncertainty. This approach emphasizes consistency over perfection, using small, steady steps that compound into lasting security. Ultimately, Retirement Ready brings together retirement planning, retirement savings, and income coordination into an actionable, sustainable process that grows with you.