Global Finance Explained helps you see how interconnected the world’s money systems are and how markets move when new data, policy shifts, or shifts in expectations arrive. From global financial markets to currencies and bonds, the forces behind price changes involve the factors driving market movements, not just headlines. Economic indicators, corporate results, and consumer trends provide the signals that inform investing basics for market awareness. Understanding the big picture helps you navigate volatility and align decisions with long-term goals. By reading this guide, you will gain practical ideas you can apply to your own finances and decisions.

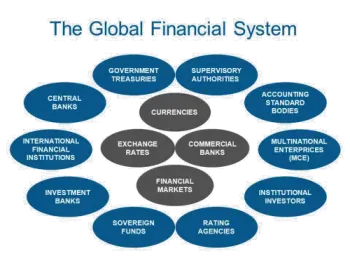

Viewed through the lens of the global financial system, world markets operate as a dynamic network where price discovery is driven by data, policy, and collective sentiment. This framing emphasizes market dynamics that connect currencies, bonds, equities, and commodities across borders. Using alternative terms such as market mechanisms, indicators, and asset classes helps readers understand how the pieces fit together. In practice, observers monitor economic indicators and central bank signals to anticipate shifts in risk, opportunity, and portfolio strategy.

Global Finance Explained: How Markets Move and What Drives Them

Global Finance Explained sets the stage for understanding why prices shift across markets. It focuses on how markets move by examining the balance of buyers and sellers, the flow of information, and the wider global context that makes price discovery a shared, cross-border process in the global financial markets.

Understanding the factors driving market movements helps readers connect headlines to portfolio outcomes. From central bank signals to geopolitical developments, the interplay of liquidity, risk sentiment, and policy expectations shapes returns in equities, bonds, and beyond within the global financial markets.

Global Finance Explained in Practice: Reading Economic Indicators and Investing Basics for Market Awareness

By focusing on economic indicators, investors translate data into meaning for their plans. This section shows how to read inflation measures, employment data, GDP, and PMIs to gauge economic momentum and the likely path for interest rates, currency values, and asset prices in the global financial markets.

Investing basics for market awareness guide readers to translate these insights into action. Setting goals, diversifying across asset classes, and using a disciplined process helps you navigate how markets move over time, anchoring decisions in fundamentals rather than noise in the news.

Frequently Asked Questions

Global Finance Explained: How do markets move in global financial markets, and what are the main factors driving market movements?

Markets move as buyers and sellers update prices based on new information and changing expectations. In global financial markets, price changes reflect supply and demand, policy signals from central banks, and shifts in risk sentiment. The main factors driving market movements include economic indicators, monetary and fiscal policy, corporate earnings, and geopolitical developments. Understanding these dynamics helps you interpret headlines and anticipate potential portfolio effects over time.

Global Finance Explained: How should investors use economic indicators and investing basics for market awareness to navigate global financial markets?

Economic indicators act as weather reports for markets, signaling the health of economies and the likely path for assets. By tracking inflation, employment, GDP, and manufacturing or services activity, you gain insight into global financial markets and potential moves in stocks and bonds. Combine this with investing basics for market awareness—diversify across asset classes, align risk with your time horizon, and stay disciplined about monitoring indicators and central bank signals rather than reacting to every headline.

| Section | Key Points | Notes / Examples |

|---|---|---|

| How markets move: mechanics | Price movement comes from supply and demand; drivers include news/data, expectations, risk sentiment, liquidity, and policy/central banks. | Asset prices adjust to inflation, growth, earnings; markets are forward-looking; risk-on/risk-off dynamics; liquidity matters. |

| The drivers of market movements | Economic indicators, monetary policy expectations, fiscal policy & geopolitics, corporate fundamentals, global interconnections. | Data signals, future rate expectations, cross-border effects influence asset prices. |

| Economic indicators & interpretation | Inflation (CPI, PCE); employment data; GDP; PMI; retail sales; consumer confidence. | Indicators impact rates, spending, growth; divergences move markets. |

| Global markets in practice: cross-border dynamics | Policy moves in one country can ripple to others; diversification across geographies, sectors, and assets is prudent. | Market cycles exist; adapt strategies; focus on long-run resilience. |

| Investing basics for market awareness | Goal setting, diversification, aligning risk with time horizon, disciplined process, staying informed but not overreacting. | Automatic contributions, rebalancing, grounding decisions in fundamentals. |

| A practical framework for readers | Identify goals/time horizon; diversified core portfolio; monitor indicators and central bank signals; adjust thoughtfully; annual plan review. | Actionable steps to apply Global Finance Explained. |

Summary

Global Finance Explained is a lens for understanding how interconnected economies shape asset prices and personal finances. By recognizing how markets move, the factors driving market movements, and the meaning of economic indicators, readers can approach investments and financial decisions with greater clarity. This descriptive overview reinforces that global financial markets require disciplined planning, diversified strategies, and ongoing learning to navigate volatility and opportunities over the long term. Global Finance Explained invites readers to stay curious, monitor policy and data, and align their actions with long-term goals in a complex but rewarding financial landscape.