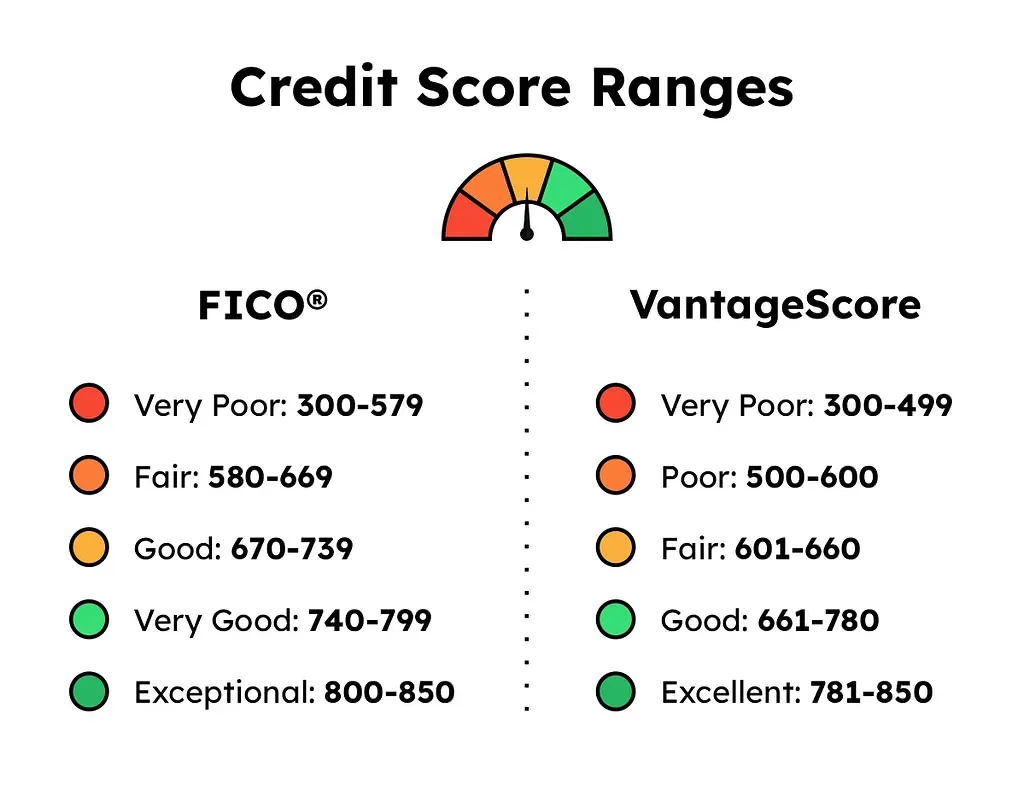

Credit scores: Demystifying borrowing for smarter lending

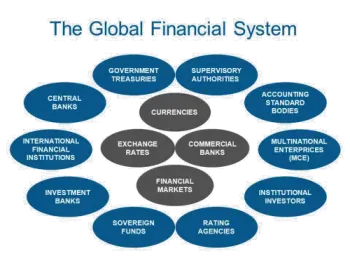

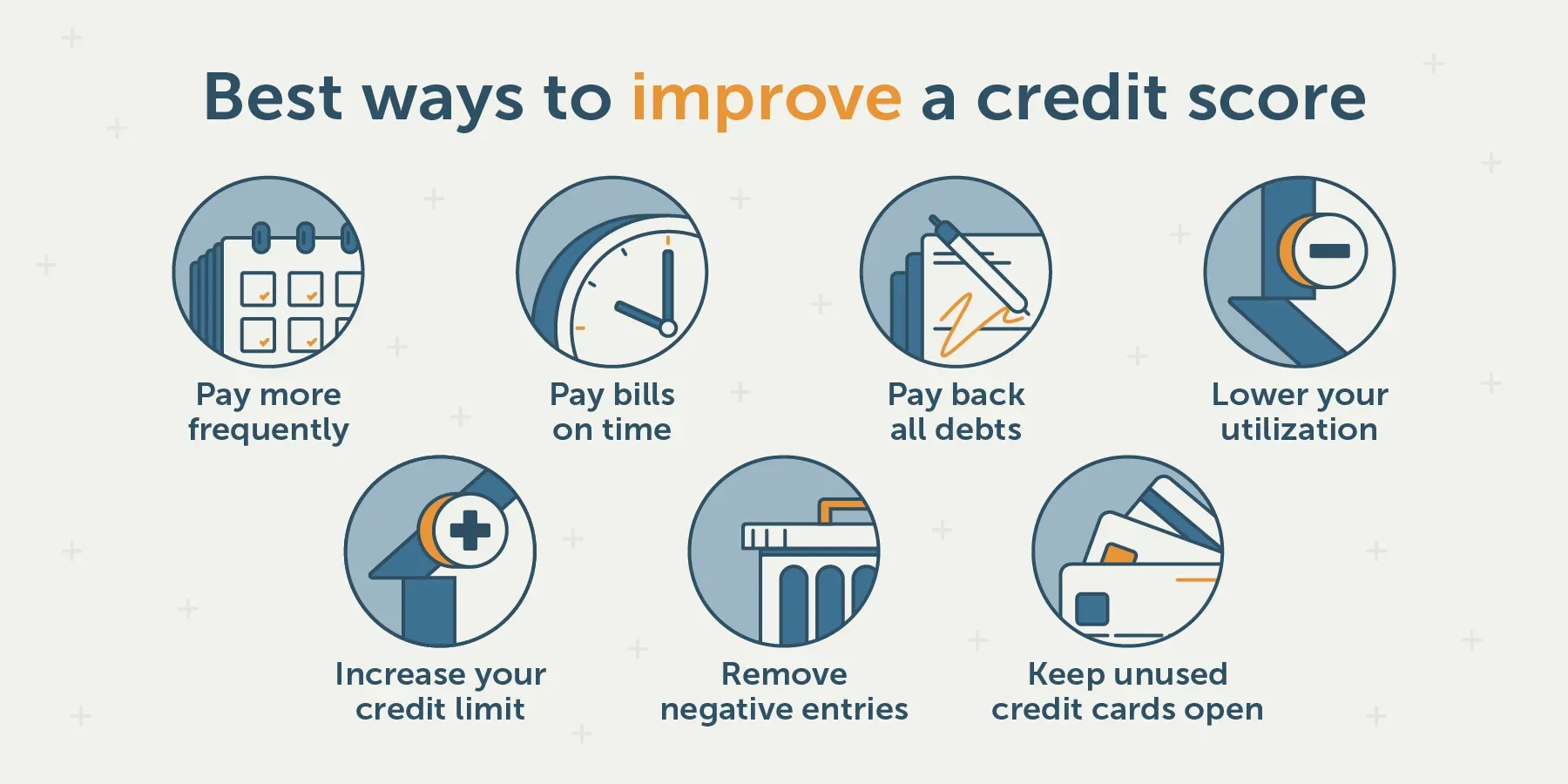

Credit scores are more than numbers; they condense years of responsible and not-so-responsible borrowing into a single gauge that lenders rely on to estimate risk, determine eligibility, and price terms, making them one of the most influential factors in everyday financial decisions that can affect your mortgage rate, credit limit, auto loan terms, insurance premiums, and even how aggressively landlords evaluate your application, while quietly guiding your choices about when to borrow, save, or consolidate debt and preparing you for unexpected shifts in rate environments or job stability.Understanding the factors affecting credit score is the first step toward borrowing smarter, because each component—payment history, amounts owed, length of history, new credit, and credit mix—collectively shapes lenders’ impressions of your reliability; the interactions among these elements matter too, for example, a single late payment can ripple through your history, while small, steady improvements in utilization can compound over months, and longstanding accounts provide a stabilizing track record that reassures lenders during economic uncertainty, across cycles and varying employment conditions.