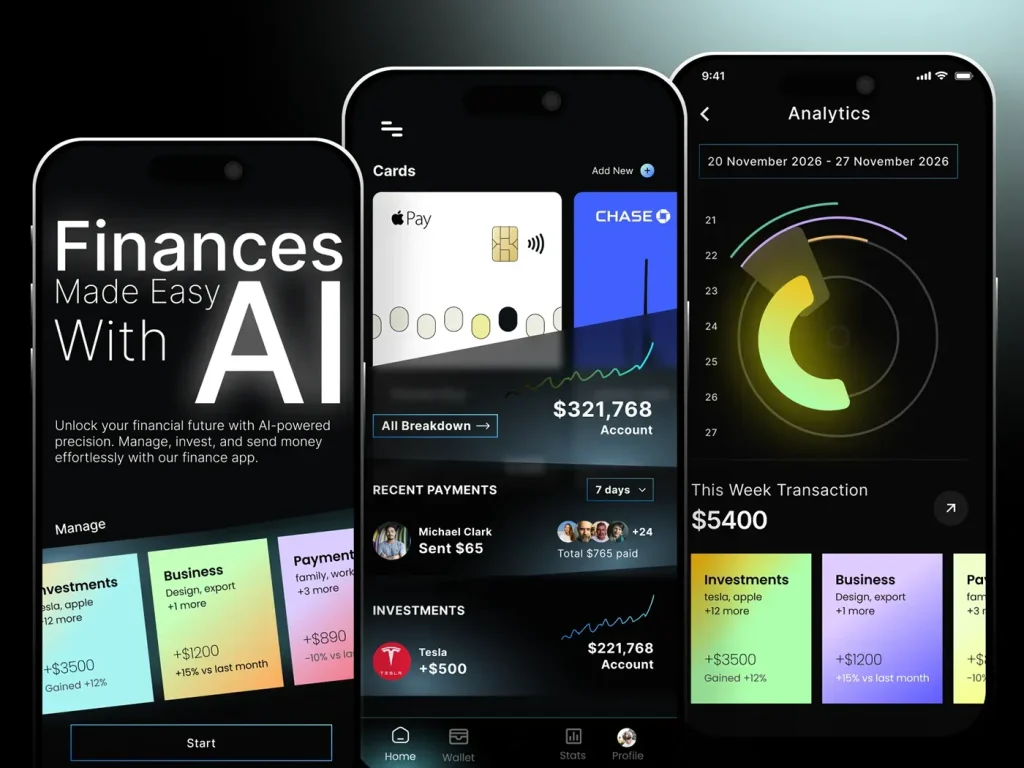

Finance apps and tools have transformed personal money management, letting you link bank accounts, monitor spending, automate savings, and track investments with just a few taps. From small screens, the best finance apps help you see where money goes, identify savings opportunities, and sharpen your overall financial strategy. Pairing money saving apps with budgeting apps and tools can categorize expenses, set sensible limits, and prompt smarter daily choices. For long-term growth, investment tracking tools offer clear performance snapshots, risk insights, and an at-a-glance view of progress toward your goals. Choosing the right mix means weighing security, costs, and ease of use so your digital money manager works smoothly within your life.

Beyond the familiar label of finance apps and tools, you can think of digital money managers, budgeting software, and portfolio trackers that pull together bank, card, and investment data. These solutions offer a holistic view of spending, savings, and growth, helping you automate routines, monitor cash flow, and keep your financial goals in sight. This broader framing aligns with modern financial wellness practices, emphasizing automation, transparency, and continuous improvement.

Finance apps and tools: A practical path to saving more and investing smarter

Finance apps and tools bring your money into view with a few taps, linking bank accounts, cards, and investment platforms to show where every dollar goes. When you use the right mix—budgeting apps and tools alongside investment tracking tools—you can see spending patterns, automate small savings, and keep long-term goals in sight. As the guide notes, the ecosystem supports better discipline and smarter decisions, aligning daily habits with goals; this aligns with terms like best finance apps, money saving apps, and personal finance apps.

Practically, start by identifying a core set: a budgeting app to categorize spending, a money saving app to automate round-ups, and an investment tracking tool to monitor portfolio health. This combination helps you understand where waste hides, automate transfers, and rebalance as markets shift. When evaluating options, prioritize security, ease of use, and the value delivered—automation that reduces manual effort while improving outcomes, and a platform that integrates with your accounts across devices.

Choosing the right personal finance apps and tools for budgeting, saving, and investing

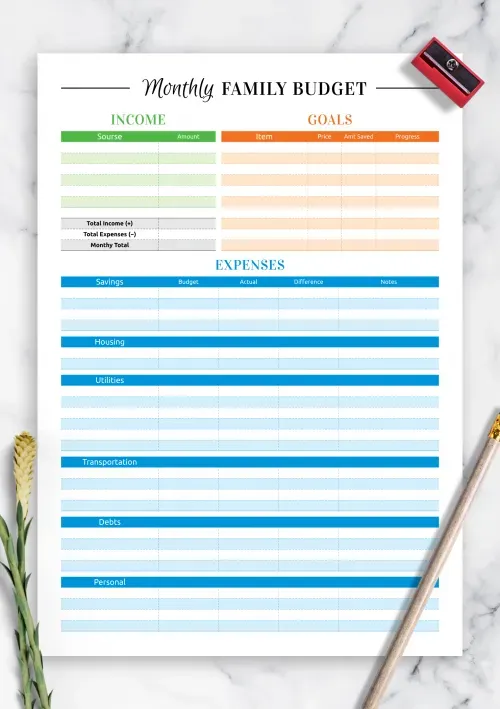

To pick effectively, consider how budgeting apps and tools, money saving apps, and personal finance apps work together to support your plan. Look for tools that provide clear dashboards, reliable data syncing, and transparent fee structures. Investment tracking tools should summarize diversification, risk, and fees in one view, while a strong budgeting app keeps you on track monthly. The goal is a cohesive set of tools that reduces decision fatigue and increases consistency.

Finally, map your selection to your goals and risk tolerance. Start with core assets: a reliable budgeting app, a core investment tracking tool, and a method for automatic savings. Explore options labeled as best finance apps to compare features, and ensure you can maintain privacy with robust security measures like two-factor authentication. By applying a thoughtful mix of personal finance apps and budgeting tools, you’ll gain a clearer path to building wealth while staying aligned with life changes.

Frequently Asked Questions

What are the best finance apps and investment tracking tools for budgeting, saving, and investing?

A solid setup starts with pairing budgeting apps and tools with investment tracking tools. Look for apps that securely link your bank accounts, credit cards, and investment accounts, show your net worth, and automate small savings into defined goals. The best finance apps deliver clear spending insights, automatic transfers to savings or debt payoff, and an easy-to-read portfolio view to support smarter investing. Prioritize strong security, cross‑platform compatibility, and transparent pricing to fit your needs.

How should I choose personal finance apps and money saving apps to align with my goals?

First, define your goals (e.g., emergency fund, debt payoff, retirement investing). Then compare options based on security, cost, ease of use, and platform compatibility. Ensure the tools support money saving apps features like round‑ups and automatic transfers, and that they can link your bank, credit, and investment accounts for a cohesive view. Look for actionable insights, reliable syncing, and good customer support to keep budgeting and investing on track.

| Topic | Key Points |

|---|---|

| Introduction | Finance apps and tools transform personal money management; with a few taps you can link bank accounts, monitor spending, automate savings, and track investments; use the right apps to save more, spend smarter, and invest smarter over time. |

| What are finance apps and tools? | Software solutions to manage money efficiently: budgeting, investment tracking, and saving tools; they connect to bank accounts, credit cards, and investment accounts to aggregate data and present clear, actionable insights. |

| Why you should care | They help establish repeatable routines, reveal inefficiencies (like unused subscriptions or small daily expenses), and drive measurable progress toward goals. |

| Key categories |

|

| How to choose |

|

| Top resources and how to apply them |

|

| Real-world workflow |

|

| Case studies and examples | Household reduces discretionary spending by identifying leaks with a budgeting app, automates weekly transfers to a high-yield savings account, and uses an investment tracker to illustrate compounding over time; net worth monitoring supports debt payoff and long-term goals. |

| Best practices for maximizing benefits |

|

| Common pitfalls to avoid |

|