Finance 101 is the practical starting point for anyone who wants to take control of their money, build confidence, and reduce financial stress. By framing money as a tool and focusing on personal finance basics, you’ll learn to track income, separate needs from wants, and set clear, achievable goals. This introductory guide introduces simple, repeatable steps that work for real people with real incomes, including budgeting for beginners, saving strategies, and a debt payoff plan. As you build your knowledge, your financial literacy will grow, helping you make smarter choices about spending, saving, and investing. By the end, you’ll have a practical blueprint you can implement this month and start moving toward real financial progress.

Beyond the surface outline, this primer reframes money knowing with terms like cash flow, net worth, and prudent saving habits. It positions money management for beginners as a practical journey of budget planning, savings growth, and stepwise debt reduction. The emphasis on financial education and literacy supports steady progress through simple, repeatable actions. By tying these related concepts to real actions—track spending, automate savings, and set debt targets—you align your day-to-day choices with long-term outcomes. This approach follows an LSI-friendly path that helps readers discover the same core ideas from multiple angles, building comprehension and confidence.

Finance 101: Mastering Personal Finance Basics through Budgeting for Beginners

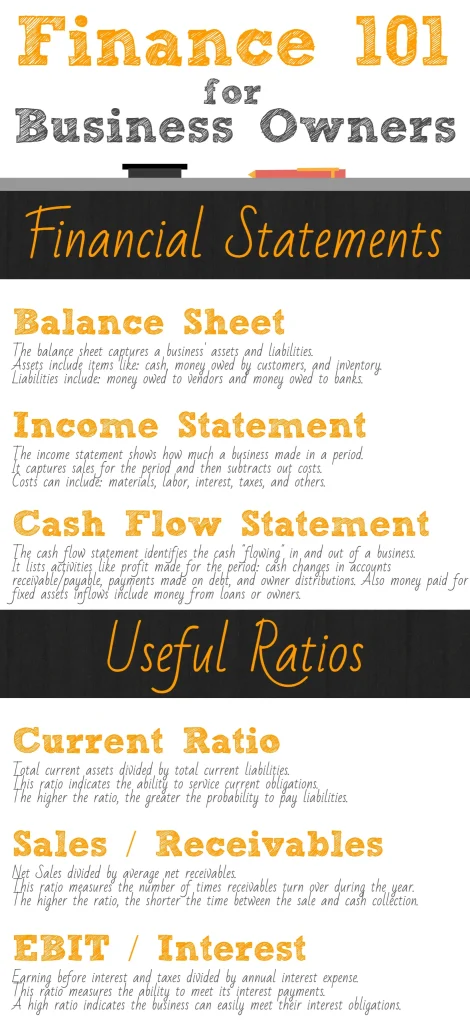

Finance 101 serves as a practical starting point for anyone who wants to take control of money. Grounded in personal finance basics, it teaches how assets, liabilities, income, and expenses shape your net worth and your ability to reach goals. By viewing money as a tool rather than a mystery, you build financial literacy and momentum, even on a modest income, so you can make smarter decisions about spending, saving, and investing.

Budgeting for beginners is where real progress begins. A simple framework like the 50/30/20 rule helps separate needs from wants while creating room for savings and debt payoff. Track your cash flow, adjust as life changes, and use automatic transfers to ensure saving strategies become automatic habits. With consistent budgeting, you can build an emergency fund and lay the groundwork for a debt payoff plan that reduces interest and boosts your confidence.

Saving Strategies, Debt Payoff Plan, and Financial Literacy: A Roadmap for Long-Term Wealth within Finance 101

Saving strategies drive long-term security by combining automation with disciplined habit formation. Start with an emergency fund that covers three to six months of essential expenses, then automate deposits into a high-yield savings account and retirement accounts such as a 401(k) or IRA. This approach leverages compounding, protects you from shocks, and enhances financial literacy as you learn how different savings vehicles grow over time.

A debt payoff plan provides a concrete path to financial stability. Compare approaches like the debt snowball and the debt avalanche, choose a strategy, and commit to regular payments. Automate minimums to avoid penalties, apply any extra funds to the target debt, and periodically reassess as income or expenses change. As you reduce debt, your credit score can improve and your financial literacy deepens, making investing basics, risk/return concepts, and diversification easier to master.

Frequently Asked Questions

What is Finance 101, and how does it address personal finance basics and financial literacy?

Finance 101 introduces the core ideas of personal finance basics—spending less than you earn, protecting what you have, and investing for the future—through actionable steps. It covers budgeting for beginners, saving strategies, and how to build a debt payoff plan, all while boosting financial literacy. By walking through assets, liabilities, income, and expenses, you gain a clear picture of your net worth and how to improve it over time.

What practical steps does Finance 101 teach for saving and paying down debt?

In Finance 101, begin with an emergency fund that covers 3–6 months of essential expenses, a key saving strategy. Automate savings so a portion of each paycheck goes to a high‑yield account. Use budgeting for beginners with the 50/30/20 framework (50% needs, 30% wants, 20% for savings and debt payoff) to free up money. Choose a debt payoff plan—debt snowball or debt avalanche—and automate minimum payments while directing any extra funds toward the chosen debt. Reassess every 3–6 months as your situation changes to strengthen your financial literacy and progress.

| Topic | Core Idea | Practical Takeaways |

|---|---|---|

| Overview / Finance 101 | Finance 101 is a practical starting point for taking control of money, reducing stress, and building confidence with simple, repeatable steps. | Start with the basics, track income and expenses, and keep jargon out of the way to build momentum. |

| 1) Understanding the basics | Money is a tool. Learn assets, liabilities, income, and expenses to estimate net worth and monitor progress. | List income sources, track every expense, and separate needs from wants to see where money goes. |

| 2) Budgeting for beginners | Apply the 50/30/20 rule (needs/wants/savings and debt payoff) and tailor it to your situation. | Use a budget template or app; monitor monthly, adjust, and stay consistent. |

| 3) Saving strategies | Build an emergency fund (3–6 months) and automate savings into a high-yield account. | Contribute regularly to retirement accounts and increase contributions gradually as income grows. |

| 4) Debt payoff plan | Choose a strategy (debt snowball or avalanche) and commit to a plan with a timeline. | Automate minimum payments, apply extra funds to the chosen debt, and reassess every 3–6 months. |

| 5) Financial literacy and investing | Understand inflation, risk/return, and the time value of money; learn about stocks, bonds, and funds. | Explore free resources and calculators; start with a diversified, long-term mindset. |

| 6) Practical tools and daily habits | Small daily habits compound into large outcomes; track expenses, use templates/apps, and automate transfers. | Regularly review net worth, cash flow, and debt progress; celebrate milestones and protect credit health. |

| 7) Common pitfalls and healthy mindsets | Watch for lifestyle inflation and impulse purchases; stay anchored to values and goals. | Maintain discipline with automated savings and debt payoff while staying adaptable to life changes. |

Summary

The table above summarizes the core points of Finance 101, outlining the foundational ideas, budgeting approaches, saving and debt strategies, literacy and investing concepts, daily habits, and common pitfalls. It provides a concise, actionable guide to start building financial confidence and resilience.