Family budgeting is more than tallying pennies; it’s about aligning money decisions with your values, goals, and daily life, turning budgeting for families into a practical, values-driven habit. When families embrace budgeting for families, they gain clarity, reduce stress, and empower every member to contribute to personal finance for families. This guide offers practical, actionable steps that work for households of all sizes, whether you’re a two-income family, a single parent managing tight resources, or a multi-generational home sharing expenses. By focusing on simple, repeatable practices like monthly budget basics and expense tracking, you can create a sustainable routine that supports short-term stability and long-term security. Together you’ll build a transparent financial picture that helps your family meet essentials, save for the future, and implement family savings strategies.

Think of this practice as household money management, or budget planning for households, where income and expenses align with daily life. From a practical standpoint, you can describe the concept as personal finance for families in action, or as monthly budget basics applied at home, to connect related ideas for readers and search engines. Expense tracking remains the backbone, turning receipts and subscriptions into actionable insights that keep the family budget on track. Framing budgeting as a collaborative effort—including family savings strategies and prudent spending discipline—helps readers see how the concept translates into everyday life.

Family budgeting: A Practical Guide for Stronger Household Finances

Family budgeting is more than a numbers exercise—it’s a way to align money decisions with your values, goals, and daily life. When families practice budgeting for families, they gain clarity and reduce stress while empowering every member to contribute to financial decisions. By embracing a simple, repeatable approach to personal finance for families, you can turn aspirations like education, emergencies, and vacations into concrete, achievable plans.

To put this into action, start by creating a transparent view of income and expenses. Track every dollar, categorize activities as needs or wants, and designate a regular portion for savings. Involve children and other household members so budgeting for families becomes a teamwork effort that supports both short-term stability and long-term security.

Monthly Budget Basics, Expense Tracking, and Family Savings Strategies

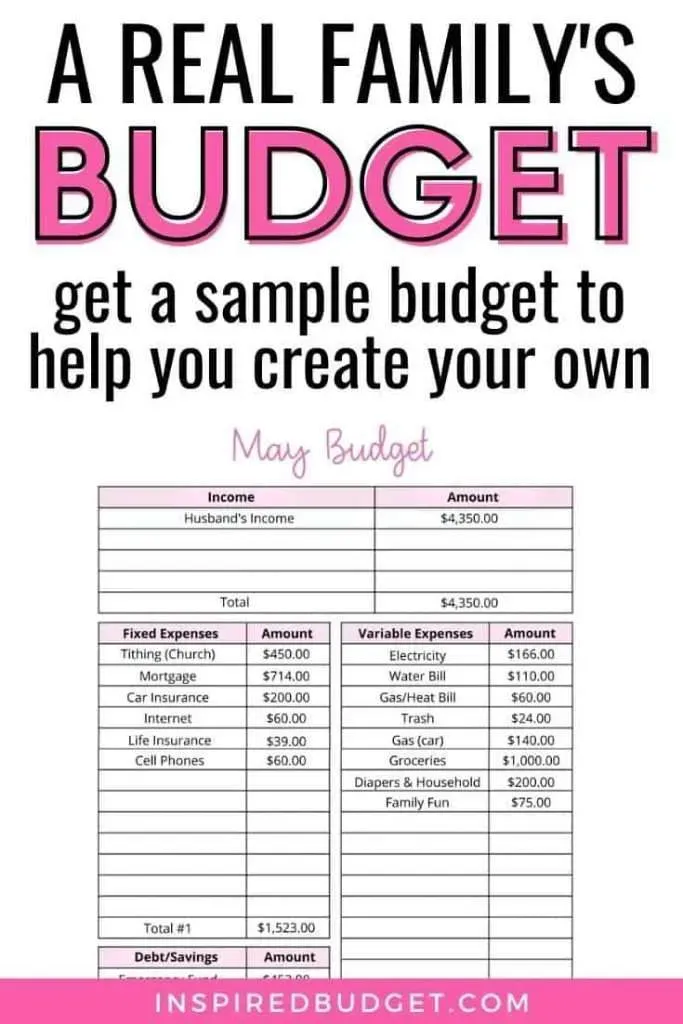

Monthly Budget Basics form the foundation of responsible money management. By listing all sources of income, setting realistic spending limits, and reviewing your plan mid-month, you keep control of where money goes and why. Expense tracking plays a crucial role here: it reveals recurring costs, impulse purchases, and seasonal spikes, enabling you to adjust before a small leak becomes a flood.

Together as a family, you can turn monthly budget basics into a practical savings engine with family savings strategies. Automate transfers to a dedicated savings account, trim unnecessary subscriptions, and plan meals to reduce waste. When you connect expense tracking with a disciplined saving habit, you build resilience against emergencies while laying groundwork for education, retirement, and shared goals.

Frequently Asked Questions

How can I start with family budgeting to improve monthly budget basics and expense tracking?

Begin by capturing all income and every expense for the month to create a clear financial picture. Use expense tracking to categorize items as needs, wants, and savings. Apply a simple monthly budget basics framework—such as zero-based budgeting or the 50/30/20 rule—and adjust mid-month as life changes. Involve every family member to build shared responsibility and set short-term goals and an emergency fund as part of your family budgeting approach.

Which practical family savings strategies best support long-term goals within family budgeting?

Automate transfers to savings so money is set aside before it’s spent, audit and trim subscriptions, plan meals with a shopping list to cut grocery waste, and adopt energy-efficient tweaks to lower bills. Tie these savings efforts to long-term targets like education funding or retirement, and maintain an emergency fund as part of the family savings strategies within personal finance for families.

| Area | Key Points | Practical Focus |

|---|---|---|

| Foundations of Budgeting | Track income and expenses to reveal the financial picture; distinguish needs, wants, and savings; ensure funds for essentials, future goals, and occasional rewards; build a transparent view for the whole family. | Create a shared monthly snapshot of income and expenses. |

| Emergency Fund & Savings | Maintain a cushion of 3–6 months of essential living costs in an accessible account; regular savings reduce stress and support long-term goals. | Automate savings toward emergency funds and long-term goals. |

| Monthly Budget Basics & Methods | List all income, track expenses for a full month, separate needs from wants, and prioritize debt and savings before discretionary spending; review mid-month. | Use zero-based budgeting or the 50/30/20 approach and adapt to your life stage. |

| Expense Tracking | Record every expense using a notebook, spreadsheet, or app; review regularly to identify patterns and adjust. | Maintain a simple, consistent tracking system. |

| Saving & Cost-Cutting Tips | Automate savings; reevaluate subscriptions; plan shopping; meal planning; energy efficiency; reduce transportation costs. | Automate transfers, audit services, shop with plans, meal prep, and save on utilities. |

| Incorporating Personal Finance in Daily Life | Teach budgeting fundamentals; involve children in age-appropriate tasks; build financial literacy and shared responsibility. | Engage kids in budgeting activities and decision-making. |

| Debt Management & Long-Term Planning | Understand interest and payoff timelines; prioritize high-interest debt; consider debt avalanche or snowball; align with savings and future goals. | Coordinate debt payoff with saving goals for balance. |

| Tools & Habits | Budgeting apps or spreadsheets; weekly household money check-ins; review bank statements; quarterly goal reassessment; maintain an emergency fund. | Use the tools consistently and establish regular budgeting rituals. |

| Special Scenarios | Children education costs, activities, and healthcare needs; single-income challenges; large or extended families sharing resources. | Tailor budgets to family structure and priorities. |

| Common Pitfalls | Lifestyle inflation, underestimating irregular expenses, and neglecting ongoing savings; failing to update goals. | Regularly cushion irregular costs and revisit goals after life changes. |

| Impact on Family Well-Being | Financial clarity reduces stress, improves decision-making, and fosters teamwork; practical money skills support all generations. | Foster family cooperation and resilience through budgeting. |