Essential finance apps empower you to take control of your money by turning complex statements into clear, actionable insights you can act on today, whether you’re just setting up a budget, tracking ongoing spending, or planning for future goals. When you choose a smart mix of budgeting features, expense tracking apps, and automation, recurring tasks get handled, spending anomalies surface quickly, and you gain real-time visibility into cash flow that previously required dozens of spreadsheets. The right tools narrate your money story rather than merely tallying numbers, highlighting where your dollars go, informing decisions about debt repayment, savings, and investments, and providing proactive guidance to stay on track. For many readers, the value comes from integration: a single dashboard that links bank accounts, cards, loans, and investment accounts so you can monitor net worth, track progress toward goals, and adjust plans with confidence. Starting with a core set of essentials and gradually expanding as needs evolve helps you build resilience while keeping complexity manageable.

In an LSI-style approach, you can think of these tools as a core digital money management toolkit that combines budget planning, spend tracking, and portfolio monitoring to support steady progress toward financial goals. Alternative terms you’ll encounter—budgeting software, cash-flow dashboards, debt payoff aids, and retirement planning calculators—describe similar capabilities from different angles, helping search engines connect related concepts without overusing a single phrase. A cohesive set delivers a smooth workflow, pulling feeds from banks, syncing transactions across apps, and presenting a single view of spending, saving, and investing so you act with confidence. Prioritize dashboards, strong security, and automation to ensure consistency across devices, so your money picture stays clear whether you’re at home, in the office, or on the go.

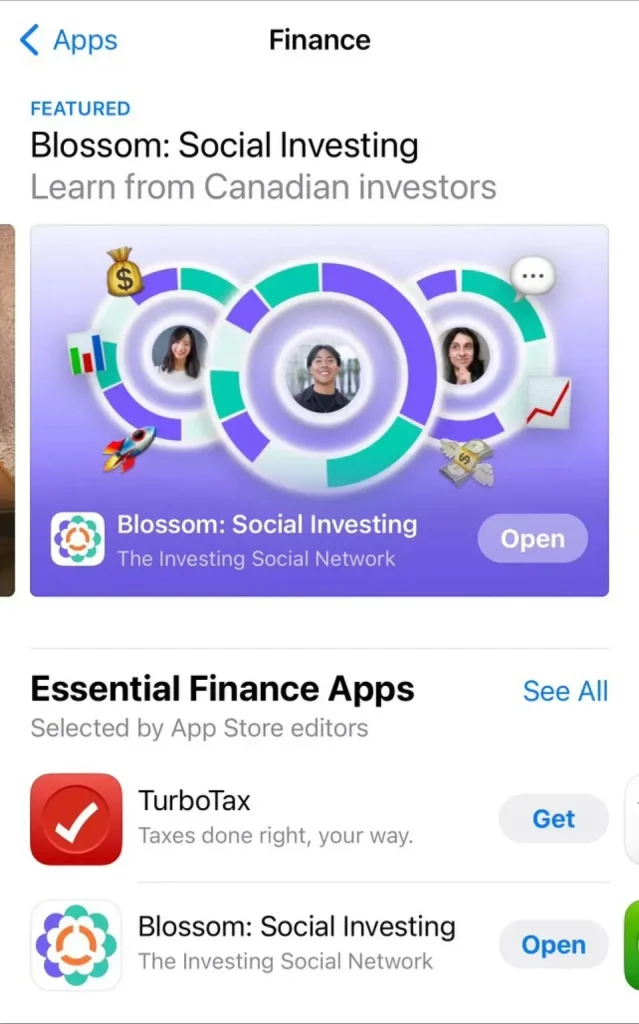

Essential Finance Apps for Budgeting and Expense Tracking

Essential finance apps bundle budgeting and expense tracking into a single workflow. They support finance apps for budgeting by automatically importing transactions, categorizing spending, and showing trends over time. When you pair these with money management tools, you get a real-time cockpit that illuminates where every dollar is going and how it supports goals like debt payoff or saving for a down payment. The integration of expense tracking apps with budgeting helps you close the loop between planning and execution, turning aspirations into action.

To choose effectively, look for apps that offer multi-device syncing, strong data security, and clear expense categorization. Seek features such as auto-categorization, rule-based budgeting, and the ability to link multiple bank accounts. This aligns with the idea of finance apps for budgeting and expense tracking, and ensures you’re applying the right money management tools to your financial life. In 2025, the best suites blend budgeting and expense tracking with simple dashboards that reveal your cash flow, upcoming bills, and progress toward goals—without overwhelming you.

Personal Finance Apps and Investment Tracking: Aligning Money Management Tools with Your Goals

Personal finance apps and investment tracking tools together empower you to manage assets, debts, and retirement planning. Using personal finance apps helps you build a coherent money management strategy by consolidating income, expenses, and investments in a single place. Investment tracking tools add visibility into performance, fees, diversification, and risk exposure, so you can maintain alignment with your long-term objectives while staying within a comfortable risk tolerance.

Real-world workflows show how these tools complement each other: a dashboard provides net worth, cash flow, and upcoming obligations; budget and expense insights inform how much you can automate toward investment contributions; and alerts keep you on track for savings goals. When selecting these tools, prioritize security, privacy, and portability of data across platforms, plus the ability to export or share data with a financial advisor. That way, you leverage money management tools and personal finance apps to drive steady growth in your portfolio while avoiding unnecessary risk.

Frequently Asked Questions

What are Essential finance apps and how can finance apps for budgeting and expense tracking improve money management?

Essential finance apps are a curated set of digital tools that automate routine tasks, illuminate spending, and help you make smarter money decisions. By pairing finance apps for budgeting with expense tracking apps and other money management tools, you gain real-time bank syncing, intuitive dashboards, and automatic categorization that show where every dollar goes and support progress toward goals. They may also include debt management, savings automation, and investment tracking tools to give you a complete picture of your finances.

How should I select the right Essential finance apps for budgeting, expense tracking, and investment tracking tools?

Start by defining your goals (budgeting, debt payoff, or investment tracking) and confirm platform availability (iOS, Android, or web). Look for strong automation, secure data handling, expense tracking capabilities, and seamless data portability in personal finance apps and money management tools, and assess how well the app integrates with your other accounts to present a unified dashboard. Finally, compare pricing, privacy, and support to choose a practical mix of Essential finance apps that fit your life and cover investment tracking tools.

| Key Point | Description |

|---|---|

| Headline concept | The Essential Finance Apps and Tools for Modern Money Management provides a practical blueprint for gaining clarity, control, and confidence over your finances. |

| What makes Essential Finance Apps powerful? | Automation, real-time bank syncing, intuitive dashboards, and proactive insights turn chaotic finances into a clear, actionable plan. |

| Budgeting and expense tracking | Apps automatically categorize transactions, show trends, and alert you if you veer off plan; combining budgeting and expense tracking creates a strong feedback loop. |

| Personal finance dashboards and money management tools | Dashboards consolidate income, expenses, assets, and liabilities into a single view, showing net worth, cash flow, and progress toward goals. |

| Investment tracking tools | Track performance, fees, diversification, and asset allocations with real-time data to align with risk tolerance and long-term goals. |

| Debt management and bill reminders | Track due dates, automate payments, and forecast payoff timelines to reduce late fees and improve repayment progress. |

| Saving, goals, and automation | Set savings goals (emergency funds, down payments) and automate transfers or round-ups to make progress effortless. |

| Choosing the right mix and practical considerations | Security and privacy are non-negotiable; choose tools with strong encryption, 2FA, cross-device support, and reliable data syncing. Consider cost and user support. |

| Security and privacy considerations | Use strong, unique passwords; enable two-factor authentication; review permissions; prefer apps with end-to-end encryption and clear data retention policies. |

Summary

Essential finance apps enable a descriptive view of money that blends budgeting, expense tracking, investment monitoring, and debt management into a coherent daily practice. By choosing the right mix of tools aligned with your goals, you gain clarity, consistency, and control over your finances. This approach reduces manual work, improves decision-making, and helps you build a healthier long-term relationship with money.