The Economics of Econmi brings a practical, data-driven lens to how theory translates into tooling and tangible impact. This approach shows how Econmi theory informs user interfaces, pricing, and strategic choices across fintech economics and broader digital markets. By linking data-driven insights with transparent measurement, the framework translates abstract incentives into concrete tooling and actions. The Econmi tooling component makes complex models accessible to analysts, product teams, and policymakers alike. With a focus on impact, the discussion highlights efficiency gains, risk awareness, and more transparent market outcomes.

Viewed through a broader lens, the topic translates into a practical economic framework that emphasizes incentives, information flows, and policy-relevant design choices. Think of it as platform economics in action, where decisions by users and providers shape prices, quality, and risk sharing. From the data perspective, this approach relies on data-driven insights, causal reasoning, scenario analysis, and transparent modeling to guide strategy and governance. Ultimately, the aim is to convert abstract theory into usable tools, dashboards, and guidelines that support responsible innovation in digital finance.

Economics of Econmi: From Econmi theory to data-driven insights in fintech economics

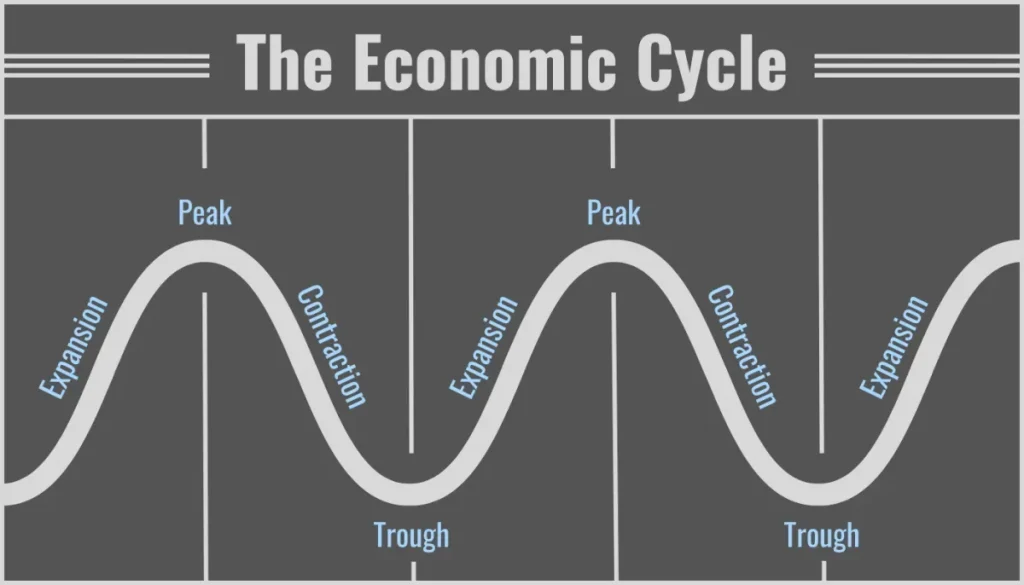

At its core, the Economics of Econmi bridges scholarly ideas with real-world decisions in fintech economics. It begins with Econmi theory—classic microeconomics, game theory, and information economics—and extends into incentives, market dynamics, and the flow of information in complex networks. By examining how agents anticipate others’ actions and how signals travel, this framework explains why certain products or policies succeed and others falter, even when starting conditions look similar. It also embraces data driven insights as a core discipline, ensuring models remain interpretable, robust, and relevant to practitioners.

To move from theory to practice, Econmi tooling translates concepts into usable outputs. The tooling stack includes modular data pipelines, feature engineering, model fitting, scenario analysis, and dynamic dashboards that help analysts, product teams, policymakers, and executives understand economic implications without needing deep economics training. Transparency and auditability are built in through provenance tracking, explainable interfaces, and clear documentation, so stakeholders can see what was done, why, and how inputs shaped outcomes. In fintech contexts, this combination of theory and tooling provides data driven, actionable guidance for pricing, risk management, and strategic decisions.

Econmi Tooling and Impact Measurement: Turning Theory into Transparent, Actionable Economics

Measuring Econmi impact involves counterfactual analysis, causal inference, and scenario planning to quantify efficiency gains, welfare effects, risk reductions, and market resilience under alternative rules or interventions, especially in fintech economics contexts.

Beyond methods, this dimension emphasizes governance, transparency, and interpretability. Clear explanation interfaces, robust data governance, and ongoing validation help ensure that insights lead to accountable action. Real-world use cases—from pricing experiments and product design to market design and regulatory evaluation—illustrate how the Economics of Econmi can align incentives, improve decisions, and deliver measurable impact for firms, customers, and policymakers.

Frequently Asked Questions

What is the Economics of Econmi, and how does Econmi theory translate into practical tooling and data-driven insights in fintech economics?

The Economics of Econmi blends Econmi theory—centered on incentives, information, and uncertainty—with practical Econmi tooling to produce actionable data-driven insights in fintech economics. By turning theory into transparent data pipelines, models, and scenario analyses, it helps practitioners forecast outcomes, align incentives, and measure impact across markets, firms, and policy. The approach emphasizes explainability and auditable outputs to support robust decision making.

How does Econmi tooling enable impact assessment and decision making in fintech economics through data-driven insights and Econmi impact?

Econmi tooling translates theory into practical outputs by providing modular data ingestion, model fitting, and scenario planners that generate data-driven insights. Through counterfactual analysis, causal inference, and scenario planning, practitioners quantify Econmi impact—such as efficiency gains, risk reduction, and market resilience—while maintaining transparency, governance, and explainability in fintech economics.

| Aspect | Key Points |

|---|---|

| Theory Backbone | Core microeconomic ideas: incentives and constraints; integrates game theory, behavioral economics, and information economics; decisions shaped by expectations, available information, and signal propagation across networks. |

| Incentives under Uncertainty | Design of mechanisms and interfaces that align individual goals with broader objectives; equilibrium depends on information asymmetries, timing, and action costs; formal models provide interpretable trade-offs. |

| Data-Driven Decision Making | Data treated as evidence to reduce uncertainty when models are robust and transparent; data quality, model assumptions, and interpretability are integral; disciplined estimation with calibration, validation, and continual learning. |

| Tooling Ecosystem | Cohesive software, data pipelines, simulation engines, dashboards, and collaboration workflows translating theory into actionable outputs; modular components that are transparent and auditable; data governance and provenance. |

| Data Pipelines & Governance | Quality, resilience, governance, provenance tracking, and rigorous cleaning embedded in the workflow to ensure data-driven outputs reflect reality while acknowledging measurement limits. |

| User-Facing Insights | Dynamic dashboards, scenario planners, and interactive reports enable exploration of what-if questions; collaboration features support cross-functional teams; linking economic reasoning with engineering discipline. |

| Measuring Impact | Counterfactual analysis, causal inference, and scenario planning to quantify efficiency gains, welfare effects, risk reduction, and market resilience; emphasize external validity and cross-context checks. |

| Real World Applications | Pricing models, product design, market matching, financial services, and policy evaluation; aims for evidence anchored in theory, data, and rigorous analysis. |

| Challenges & Future | Data privacy and security, model risk, interpretability, governance, and the human element; future trajectory emphasizes real-time analysis, broader scenario libraries, and granular segmentation with explainable tooling. |

Summary

Economics of Econmi is a practical approach to building better economic tools and delivering measurable impact. By marrying Econmi theory with robust tooling and data driven insights, organizations can illuminate the pathways from decision to consequence. The Economics of Econmi bridges incentives, information, markets, and technology, highlighting the interdisciplinary nature of fintech economics and data driven insights. As you consider adopting these ideas, focus on transparent models, rapid experimentation, and impact measurement to guide future decisions. When theory, tooling, and impact align, the Economics of Econmi can drive not only better business outcomes but also more thoughtful policy and a more stable digital economy.