Econmi vs Traditional Indicators is reshaping how decision-makers gauge the economy in real time and determine where to focus scarce resources. As markets hum with high-frequency signals, Econmi indicators provide near real-time data streams, while traditional indicators still ground analysis with long-run baselines and methodological rigor. These dynamics reveal pros and cons of Econmi as we weigh the speed of insight against concerns about data quality, transparency, and the risk of overfitting. Use cases for Econmi span finance, supply chain resilience, and policy scenario planning, illustrating how rapid signals can complement established metrics for faster decision cycles. economic indicators comparison across contexts shows that a blended approach often yields more robust guidance than relying on a single source.

Framing this topic through an LSI lens, modern metrics built on high-frequency data and alternative data streams act as complementary signals rather than direct replacements. Instead of relying solely on GDP, unemployment, or CPI, analysts pair near real-time readings with established macro measures to balance speed with context. This broader, semantic approach aligns with search intent and reader expectations by weaving related terms such as timely signals, data fusion, cross-validation, scenario planning, and resilience analytics. Such framing helps audiences grasp how rapid indicators can inform tactical decisions while traditional data anchors the implications in history and theory. By applying LSI principles, content becomes clearer for web platforms and stakeholders who value both speed and rigor. as a result, readers learn to interpret signals in context, distinguishing momentum signals from noise.

Econmi vs Traditional Indicators: Speed, Context, and Use Cases in Modern Analytics

Econmi indicators rely on high-frequency data streams, alternative data sources, and advanced analytics to deliver near real-time signals about economic conditions. Unlike traditional indicators, which often lag by weeks or months, Econmi indicators are designed to provide quick situational awareness that can inform tactical decisions. By incorporating data such as online pricing, shipping activity, energy usage, and credit card transactions, these indicators aim to triangulate momentum and detect turning points earlier. This aligns with the broader goal of leveraging Econmi indicators to improve responsiveness in fast-moving markets.

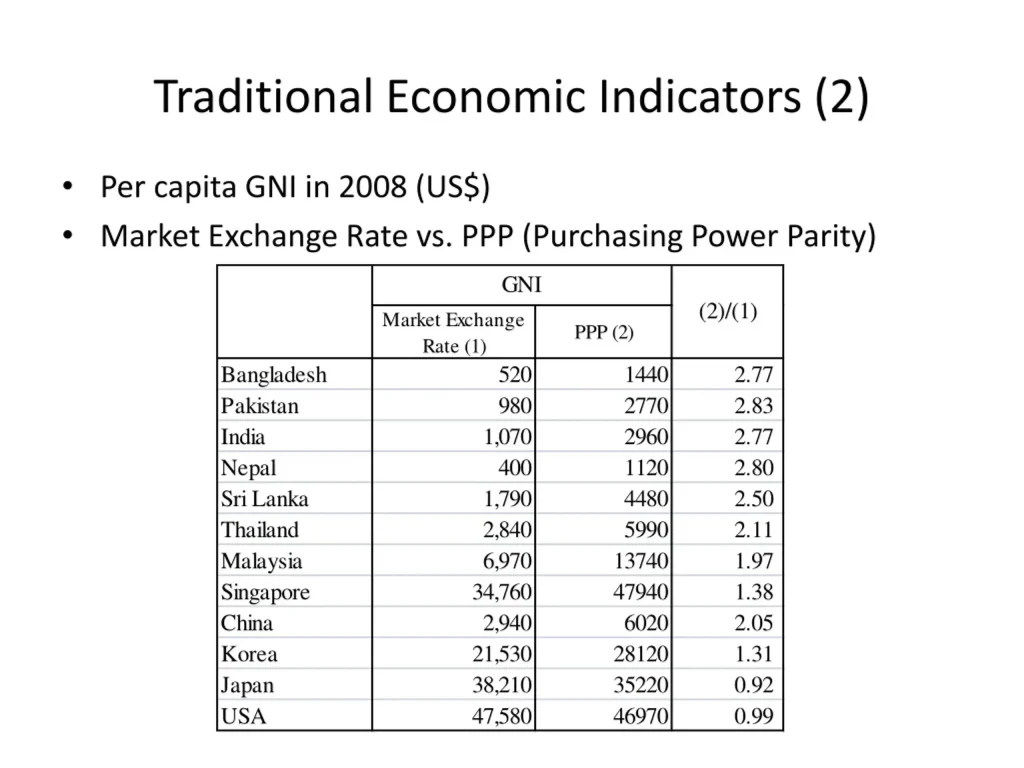

Traditional indicators, in contrast, offer methodological rigor and well-established baselines. Metrics like GDP, unemployment, CPI, and industrial production provide depth, historical context, and cross-country comparability that are essential for policy evaluation and long-run trend analysis. However, their release lags and retrospective revisions can limit rapid decision-making, particularly in volatile environments where timely context matters. Understanding the strengths and limitations of traditional indicators is central to the economic indicators comparison discussed in strategic analytics planning.

From an overall perspective, the economic indicators comparison suggests that neither approach alone fully solves decision problems. The pros and cons of Econmi—such as real-time insights versus potential data noise—need to be weighed against the reliability and depth of traditional indicators. A practical takeaway is to map decision problems to the appropriate data cadence and to design validation steps that harmonize signals from both sources, enabling a balanced, informed response.

Hybrid Analytics: Leveraging Econmi indicators with Traditional Indicators for Economic Insights

A hybrid analytics approach combines Econmi indicators with traditional indicators to capture both speed and depth. Use cases for Econmi indicators include financial markets, supply chain and operations planning, and crisis response, where near-real-time signals can guide rapid adjustments while traditional metrics underpin governance and strategic planning. This use of Econmi indicators complemented by traditional indicators supports a more robust economic indicators comparison, helping organizations triangulate signals and reduce reliance on a single data stream.

Implementation starts with a focused problem: identify decision areas such as inventory management, pricing, or marketing spend where timely signals matter. Build a validation layer that compares Econmi signals with traditional indicators; establish governance to document data provenance, validation rules, and model assumptions. Prioritize explainability to ensure stakeholders understand why a signal appeared and what actions it warrants, and invest in data governance to minimize biases and drift while maintaining a clear balance between Econmi indicators and traditional benchmarks.

Further considerations include structuring data architectures for cross-source reconciliation, applying cross-checks and triangulation when signals diverge, and designating ownership for model updates. By implementing a practical framework that emphasizes timeliness with validation and governance, organizations can exploit the best of both worlds—accelerated insight from Econmi indicators and the reliability of traditional indicators—without sacrificing trust or methodological soundness.

Frequently Asked Questions

What is the difference between Econmi indicators and traditional indicators, and when should you prefer Econmi indicators for decision-making?

Econmi indicators are a new generation of metrics that leverage high-frequency data and alternative sources to provide near-real-time signals about economic conditions. Traditional indicators, such as GDP, unemployment, CPI, and industrial production, are methodologically rigorous but can lag by weeks or months. For economic indicators comparison, Econmi indicators shine in fast-moving decision contexts where timeliness matters, while traditional indicators provide depth, historical baselines, and policy relevance. Key use cases for Econmi indicators include financial markets, supply chain operations, and crisis management, where rapid signals can guide quick actions. A practical approach is to use Econmi indicators for real-time situational awareness and to validate those signals against traditional indicators to ensure alignment with longer-run trends and governance standards. Always consider data quality, representativeness, and the risk of false positives when relying on Econmi indicators and maintain a transparent data governance process.

What are the pros and cons of Econmi indicators versus traditional indicators, and how can organizations implement a hybrid approach that leverages economic indicators comparison?

Pros of Econmi indicators include real-time or near-real-time insights, early warning signals, agility for scenario planning, and the ability to complement traditional metrics. Cons include data quality and coverage concerns, thinner historical context, potential overfitting, and governance or transparency challenges. Traditional indicators offer methodological rigor, rich historical context, and policy relevance, but suffer from timely gaps and limited granularity for fast decisions. A practical hybrid approach pairs the speed of Econmi indicators with the robustness of traditional indicators: validate Econmi signals against traditional benchmarks, triangulate data sources to investigate divergences, map signals to specific use cases (operational versus governance decisions), and establish data governance with clear ownership and validation rules to maintain transparency and trust.

| Topic | Key Points | Notes / Examples |

|---|---|---|

| What are Econmi indicators? | A newer generation of metrics using high-frequency data and alternative data sources with advanced analytics to provide near-real-time economic signals. | Aim: detect turning points, forecast near-term developments, and react quickly to risks. Data examples: online pricing, shipping, energy usage, credit card transactions. |

| What are traditional indicators? | Classic measurements like GDP, unemployment, CPI, and industrial production; methodologically rigorous with long-standing baselines. | Strengths: well-understood methods; weaknesses: release lags and retrospective revisions. |

| Pros of Econmi indicators | Real-time insights; early warnings; agility for scenario planning; complementarity with traditional indicators. | Can fill timeliness gaps while traditional metrics provide depth. |

| Cons of Econmi indicators | Data quality risks; thinner historical context; risk of overfitting; governance/transparency concerns. | Requires validation and clear explanations to stakeholders. |

| Pros of traditional indicators | Methodological rigor; rich historical context; policy relevance and legitimacy. | Provides stable baselines for long-run analysis and cross-country comparisons. |

| Cons of traditional indicators | Timeliness gaps; slower for real-time decisions; may mask regional nuances. | Not ideal for rapid tactical adjustments in fast-moving environments. |

| Use cases for Econmi indicators | Financial markets and asset management; supply chain planning; corporate strategy; crisis response. | Useful for near-term signals and operational decisions. |

| Use cases for traditional indicators | Policy analysis; long-run trend assessment; international comparisons. | Provides historical context and policy-ready benchmarks. |

| Blending the best of both worlds | Hybrid approach: timeliness with validation; triangulation; use-case mapping; governance and transparency. | Balance speed with reliability; leverage signals appropriately. |

| A practical framework for choosing indicators | 1) Define decision problem 2) Assess data quality 3) Evaluate interpretability 4) Test historical alignment 5) Establish governance | Steps help ensure signals drive actual decisions and accountability. |

| Case study snippet | Manufacturing firm faced a material shortage; Econmi signals on supplier activity and freight volumes indicated potential delay before traditional indicators did. | led to production shifts and inventory adjustments, reducing stockouts while monitoring long-term demand. |

| Practical tips for implementing Econmi indicators alongside traditional | Focus on a specific problem; build a validation layer; prioritize explainability; invest in data governance; establish governance. | Helps operationalize signals with clear accountability and adoption path. |

Summary

Conclusion: Econmi vs Traditional Indicators illustrate how organizations can blend speed and depth to improve decisions. By combining near-real-time signals with established historical context, decision-makers can respond quickly to emerging risks while maintaining rigor and governance. The practical takeaway is a balanced analytics stack that maps decision problems to the most relevant Econmi and traditional indicators, validated through transparent governance and ongoing learning.