Econmi vs traditional economic models marks a shift in how researchers and policymakers approach forecasting, expanding beyond fixed equilibria to embrace real-time data integration, adaptive feedback loops, and the behavior of heterogeneous agents as conditions move, enabling more responsive analyses that reflect the complexities of modern economies. In a traditional economic models comparison, analysts typically evaluate equilibrium conditions, long-run relationships, and well-specified utility or profit functions, while Econmi emphasizes dynamic adjustments, learning, and heterogeneity, setting up a clear contrast in how each framework treats data, policy levers, and the speed of feedback. The piece maps the economic modeling differences across data cadence, validation approaches, and forecast utility, helping readers weigh credibility, resilience under stress, and practical applicability for policy and business decisions. You will see Econmi benefits and drawbacks presented alongside traditional benchmarks, illustrating how real-time inputs, modular simulations, and scenario-based testing can boost adaptive planning while raising questions about interpretability, governance, data quality, and model risk management. Together, the introduction hints at a practical side-by-side economic analysis that equips policymakers, researchers, and business leaders with the criteria to choose the right tool for a given problem and horizon, balancing insight with governance and clarity.

Viewed through a different lens, the Econmi approach can be described as a data-driven, dynamic forecasting framework that blends traditional theory with real-time indicators, adaptive policy feedback, and modular components. This terminology leans on ideas such as real-time analytics, agent-based simulations, and machine-learning–augmented modeling to convey how mechanisms shift as new information arrives. LSI-inspired terminology helps connect this topic to related searches like dynamic macro models, policy experimentation tools, and scenario-based risk assessment, enabling a broader audience to grasp the evolving toolkit. In practice, this language helps teams bridge academic concepts with business-relevant insights.

Econmi vs traditional economic models: A side-by-side economic analysis

Econmi merges traditional economic theory with real-time data feeds and adaptive feedback. In a side-by-side economic analysis with conventional models, you can observe how Econmi emphasizes dynamic adjustments over time, accounts for heterogeneous agents, and incorporates scenario-based exploration rather than static equilibrium.

From a practical standpoint, the Econmi approach offers benefits such as responsiveness to real-time indicators and richer scenario testing, but it also carries drawbacks like increased model risk and the need for rigorous governance. The side-by-side economic analysis with traditional models shows that Econmi can capture nonlinear dynamics and feedback loops, yet might trade some transparency for richer insights. Econmi benefits and drawbacks depend on data quality, governance, and the decision context.

Traditional economic models comparison and economic modeling differences

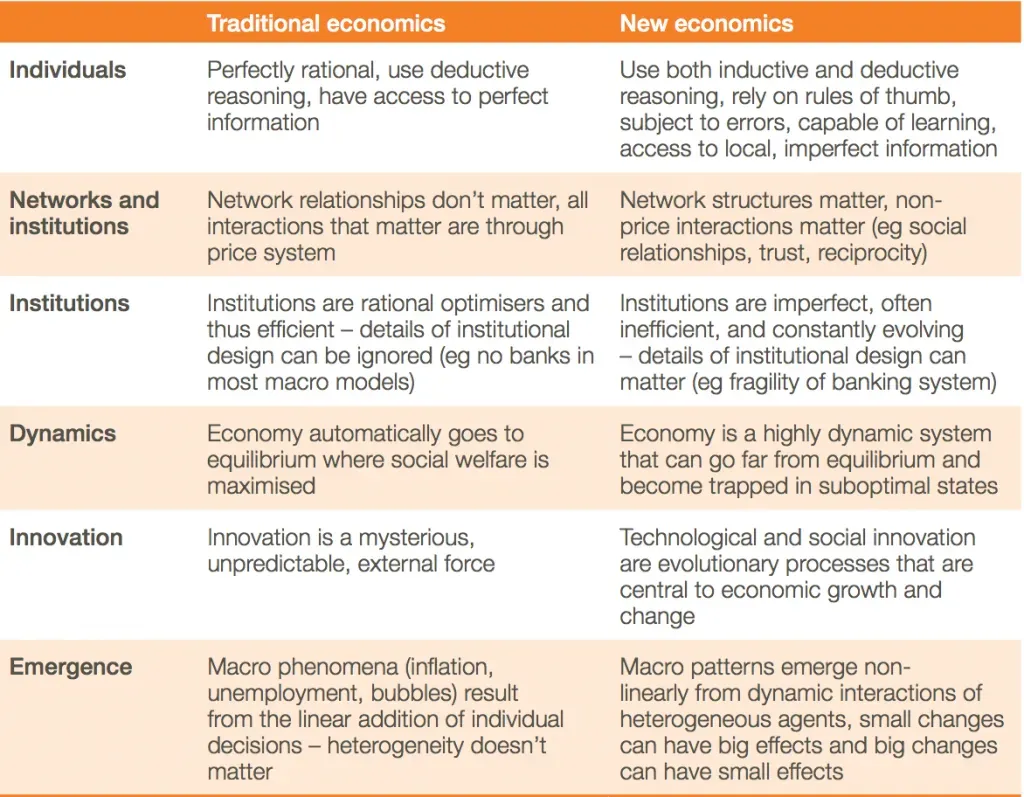

Traditional economic models provide a sturdy baseline anchored in equilibrium concepts, representative agents, and well-specified utility or profit functions. When considering traditional economic models comparison, researchers emphasize analytical tractability, transparent mechanism channels, and clean long-run relationships. The economic modeling differences between this approach and Econmi primarily show up in data timeliness, heterogeneity, and the incorporation of learning and adaptive dynamics.

While traditional models deliver interpretable results and straightforward hypothesis testing, they can struggle with rapid changes and complex disruptions. Econmi, by contrast, supports modularity, real-time inputs, and scenario analysis that can reveal non-linear responses and feedback loops. However, this comes with increased model risk and governance needs, underscoring how Econmi benefits and drawbacks depend on data quality, governance, and the decision context. In a side-by-side economic analysis, the two approaches are not competitors but complementary parts of a robust analytical toolkit.

Frequently Asked Questions

Econmi vs traditional economic models: what are the key economic modeling differences, and what does a side-by-side economic analysis reveal?

Econmi blends traditional economic theory with real-time data integration, adaptive feedback loops, and modular components to create a more responsive, scenario-driven framework. Traditional economic models emphasize equilibrium concepts, representative agents, and closed-form solutions for analytic tractability. A side-by-side economic analysis reveals several core differences:

– Assumptions and focus: Econmi emphasizes dynamic adjustments and heterogeneous agents; traditional models emphasize equilibrium and homogeneity.

– Data and timeliness: Econmi uses near real-time and high-frequency indicators; traditional models rely on quarterly or annual data revisions.

– Methodology: Econmi relies on simulations, scenario analysis, and often agent-based or machine-learning enhancements; traditional models rely on analytical derivations.

– Transparency and interpretability: Econmi can be transparent through documented policy channels and scenarios, though complexity from data and ML components can affect interpretability; traditional models are typically more transparent by construction.

– Applications: Econmi supports stress testing, adaptive policymaking, and scenario planning; traditional models excel as benchmarks for long-run relationships and clear hypothesis testing.

Overall, Econmi tends to complement traditional models, offering dynamic insights in fast-changing conditions, while traditional models provide stability and interpretability for baseline forecasts and theory-driven analysis.

Econmi benefits and drawbacks: in a traditional economic models comparison, when should policymakers favor Econmi over traditional models and when should they rely on conventional approaches?

Key Econmi benefits include responsiveness to real-time data, the ability to model heterogeneity and learning, and enhanced capabilities for policy experimentation and stress testing. Drawbacks include higher data governance requirements, potential drift from overfitting or spurious signals, and possible reductions in interpretability when machine-learning components are involved. In a traditional economic models comparison, policymakers should consider:

– Use Econmi when rapid environmental change is likely, forward-looking scenario planning is needed, or real-time data and adaptive feedback matter for decision-making (e.g., macroprudential analysis, supply-chain shocks, or policy experiments).

– Use traditional models when strong theoretical grounding, analytic tractability, clear long-run relationships, and easily communicable mechanisms are essential, especially for baselines, hypothesis testing, and transparent stakeholder communication.

In practice, the most robust approach often combines both: rely on traditional models for theory-bound benchmarks and use Econmi-like methods to stress-test, adapt to new data, and explore dynamic policy channels in uncertain environments.

| Aspect | Traditional Economic Models | Econmi | Key Takeaways |

|---|---|---|---|

| Core Concept | Rely on equilibrium concepts, representative agents, and well-specified utility/profit functions. | Dynamic adjustments, heterogeneous agents, learning effects; real-time data integration and modular design. | Offers analytic tractability and theoretical clarity; Econmi adds realism and adaptability. |

| Data & Timeliness | Depends on stable datasets with quarterly/annual revisions; limited real-time updates. | Uses near real-time indicators, high-frequency data, and faster feedback loops. | Econmi is better for rapid-change contexts but requires strong data governance. |

| Methodology | Closed-form solutions; analytical tractability is central. | Embraces simulations, scenario analysis, agent-based components, and machine-learning enhancers. | Balance between tractability and dynamic realism; Econmi broadens methodological toolbox. |

| Validation | Backtests and out-of-sample forecasts grounded in established theory. | Counterfactual testing and stress scenarios; emphasis on robustness and model risk. | Traditional validation provides transparency; Econmi validation emphasizes broader resilience. |

| Transparency & Interpretability | Typically more transparent with clear channels and channels of influence. | May be more opaque due to data/algorithmic components; requires documentation. | Maintain interpretability through documented channels and scenario logic despite complexity. |

| Applications | Policy analysis, macro forecasting, and academic research; well-established benchmarks. | Stress tests, risk assessment, time-sensitive decision support, scenario planning, policy experimentation. | Both expand the toolbox: use traditional for benchmarks and Econmi for adaptability. |

| When to Use | Strong theoretical grounding; analytic tractability; clear long-run relationships. | Rapid change, forward-looking scenarios, data integration, and heterogeneity. | Use both: align the approach with the decision context and risk tolerance. |

| Operational Considerations | Data governance, model risk management, interpretability, and skilled talent for theory. | Data governance, model risk management, interpretability, and cross-disciplinary teams. | Invest in governance and collaboration to maximize model credibility and utility. |

| Critiques & Limitations | May miss dynamic frictions; slower to adapt; interpretation can be clearer but less flexible. | Risk of overfitting, data biases, opacity; requires discipline in validation and communication. | Careful governance and validation can mitigate limitations; the blend often yields robust insights. |

Summary

Conclusion: Econmi vs traditional economic models reflects a broader shift toward dynamic, data-rich, and policy-focused analysis. Traditional models remain valuable as benchmarks and sources of interpretability, especially for long-run relationships and theoretical rigor. Econmi-type frameworks add adaptability, real-time sensitivity, and scenario-ready capabilities, enabling more robust planning in uncertain environments. The practical takeaway is to combine strengths from both approaches—use traditional models for clear channels and benchmarks, and supplement them with Econmi methods for forward-looking analysis, stress testing, and adaptive policymaking. By integrating these approaches thoughtfully, policymakers, researchers, and practitioners can achieve richer insights, improved resilience, and more informed decision-making in the face of economic uncertainty.