Credit scores are more than numbers; they condense years of responsible and not-so-responsible borrowing into a single gauge that lenders rely on to estimate risk, determine eligibility, and price terms, making them one of the most influential factors in everyday financial decisions that can affect your mortgage rate, credit limit, auto loan terms, insurance premiums, and even how aggressively landlords evaluate your application, while quietly guiding your choices about when to borrow, save, or consolidate debt and preparing you for unexpected shifts in rate environments or job stability. Understanding the factors affecting credit score is the first step toward borrowing smarter, because each component—payment history, amounts owed, length of history, new credit, and credit mix—collectively shapes lenders’ impressions of your reliability; the interactions among these elements matter too, for example, a single late payment can ripple through your history, while small, steady improvements in utilization can compound over months, and longstanding accounts provide a stabilizing track record that reassures lenders during economic uncertainty, across cycles and varying employment conditions. This guide highlights how credit scores affect borrowing, explaining how a higher score can unlock lower interest rates and better terms while a lower score may limit choices and raise the long-term cost of credit, sometimes requiring borrowers to accept less favorable conditions or higher down payments. By reading your credit score and debunking common credit score myths, you can separate fact from fiction and track progress over time, turning knowledge into concrete actions such as monitoring reports, setting alerts, avoiding unnecessary inquiries, and learning how to dispute mistakes efficiently. With practical steps and a patient, long-term mindset, you can take deliberate actions to improve credit score and build a stronger financial future—even if you are starting with a thin file, or facing disruptions that require careful budgeting and resilient credit building.

Beyond the label ‘credit score,’ readers may encounter terms like creditworthiness, lending risk metric, and risk profile that describe the same idea in different ways. This broader framing links the score to a borrower’s full financial history, including how consistently payments are made, how large debts are relative to limits, and how diversified the credit types are across time. In practice, thinking about the topic in terms of trust, reliability, and cost of borrowing helps you translate the numbers into action, guiding budgeting, debt planning, and timely monitoring across multiple lenders.

Credit scores and Borrowing: How They Shape Rates and Access

Credit scores are more than numbers; they summarize your borrowing history and help lenders gauge risk. In practice, they influence whether you are approved for a loan or credit card and, just as important, the interest rates and terms you are offered. Understanding how credit scores affect borrowing gives you a clearer target for everyday financial habits. The five factors affecting credit score—payment history, amounts owed, length of history, new credit, and credit mix—work together to produce your score, and knowing them helps you plan effective improvements.

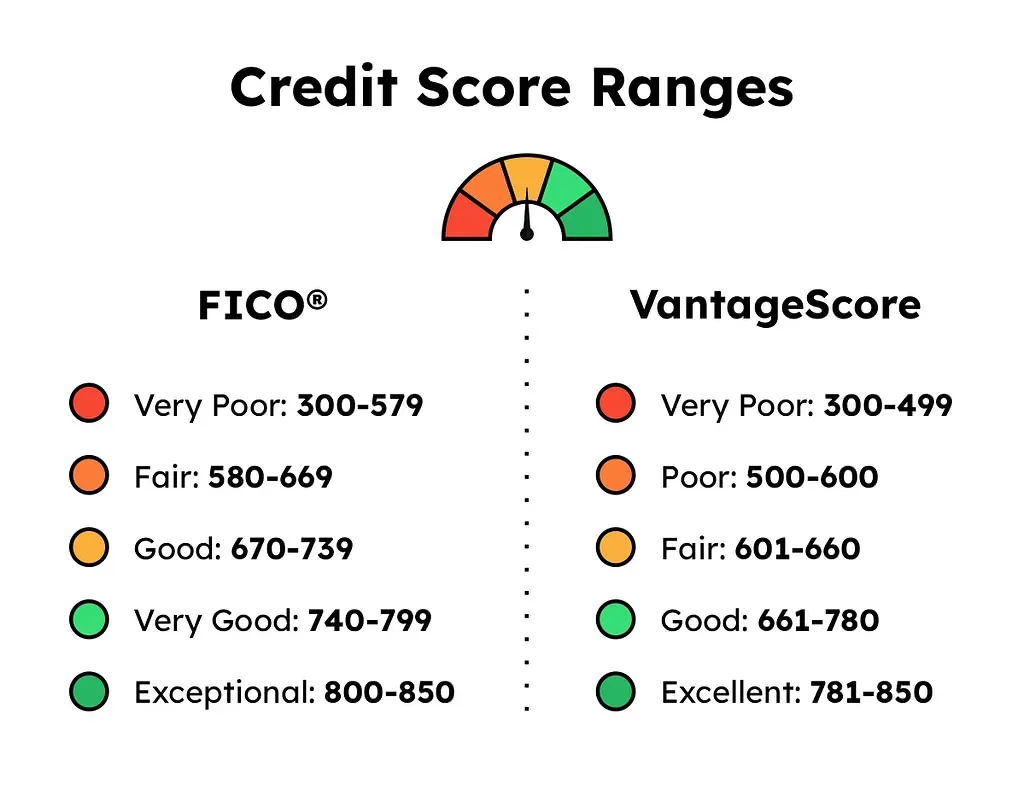

When your score is higher, you may see lower interest rates, higher loan amounts, and broader approval options. When it’s lower, lenders may impose tighter terms or require higher down payments. This dynamic underscores why small, steady changes—like paying on time and reducing balances—can lead to meaningful savings over time. Remember that lenders may use different scoring models and ranges, so your exact number may vary, but the direction and the components remain consistent across major models. This is precisely why understanding how credit scores affect borrowing—across lenders and loan types—matters.

Improve credit score: Practical steps to boost your score and understanding reading your credit score

Improving your credit score starts with reliable payment behavior and smart credit management. Make timely payments on all accounts and set up autopay to avoid late charges. Reducing revolving balances lowers credit utilization, a quick lever for score improvement, especially on cards with high limits. Keeping older accounts open preserves length of history, which helps your score accumulate positive data over time. These actions directly address the factors affecting credit score and align with the goal to improve credit score.

Reading your credit score regularly helps you stay aware of progress and catch errors before they drag your score down. Be mindful that different scoring models may produce slightly different numbers for the same data; the trend over time is the key. There are also pervasive credit score myths that can derail progress—common myths like ‘closing old accounts always hurts’ or ‘a single late payment ruins your score’—and learning the reality helps you stay focused. Use your score as a guide to monitor behavior rather than a single momentary snapshot, and remember that improving your score is a long-term, ongoing process.

Frequently Asked Questions

What are the factors affecting credit score, and how can I practically improve my credit score over time?

The five broad factors affecting credit score are payment history, amounts owed (credit utilization), length of credit history, new credit, and credit mix. Payment history is the heaviest weight; to improve your credit score focus on making on-time payments, reducing revolving balances, and avoiding late payments. Practical steps include keeping old accounts open to preserve length, limiting new credit inquiries, checking your credit reports for errors, and building credit if your history is thin with secured cards or credit-builder options. Steady, responsible habits typically yield meaningful improvements in your credit score over time.

How do credit scores affect borrowing, and what credit score myths should I know when reading your credit score?

Your credit score directly influences loan approvals and the terms lenders offer. A higher score often means lower interest rates and better borrowing terms, while a lower score can limit options and raise costs. Common credit score myths debunked include: one late payment can ruin your score if recent; closing old accounts reduces available credit and can shorten average age; checking your own score is a soft inquiry and does not hurt it; paying off debt will not cause an overnight jump; and you should not chase a single factor at the expense of overall responsible behavior. Reading your credit score regularly helps you spot errors and monitor progress, noting that different scoring models may yield slightly different scores.

| Topic | Key Points |

|---|---|

| What is a Credit Score? | – A three-digit summary produced by scoring models such as FICO and VantageScore. – Typically ranges from 300 to 850; higher equals lower risk. – Models vary by bureau; your score may differ slightly across providers. |

| Why it matters for borrowing (How it shapes borrowing) | – Directly affects loan/card approvals and interest rates. – Higher scores usually mean lower rates and better terms; lower scores limit options and raise costs. |

| Key factors affecting score | – Payment history (heaviest weight). – Amounts owed/credit utilization. – Length of credit history. – New credit. – Credit mix. |

| How to improve your credit score | – Make timely payments on every account. – Reduce credit utilization (aim under 30%). – Preserve long-standing accounts. – Be cautious with new credit. – Check reports for errors. – Build credit if your file is thin (secured cards, credit-builder products, authorized user). |

| Common credit score myths debunked | – Myth: One late payment or big purchase ruins your score. Reality: Not ideal, but recovery happens with time. – Myth: Closing old accounts always hurts. Reality: It can reduce available credit and shorten age, but not always permanent. – Myth: Checking my score hurts it. Reality: It’s a soft inquiry. – Myth: Paying off debt makes scores jump overnight. Reality: Improvements take time. – Myth: You only need to focus on one factor. Reality: A balanced approach yields best long-term results. |

| Reading your credit score | – Score is separate from the full report; models differ. – Regular monitoring helps spot errors and plan actions. – Differences across models are normal; focus on overall direction. |

| Putting it into practice: a simple plan | – 90-day plan: pull reports, review for errors, set alerts; automate payments; reduce utilization; avoid unnecessary new accounts; monitor progress and adjust strategy as needed. |

| The role of soft and hard inquiries | – Hard inquiries can lower scores briefly; soft inquiries don’t affect scores. – Shop for rates within a limited window to minimize impact. |

Summary

Table of key points about credit scores: definitions, factors, impact on borrowing, improvement steps, myths, monitoring, practical plans, and inquiries.