Cash Flow for Small Businesses is the lifeblood that determines whether you can seize opportunities or simply survive. A healthy cash position enables proactive decisions and aligns with cash flow forecasting for SMBs, budgeting for small business, profitability strategies, and working capital management for small business. This guide explains what cash flow means for small businesses, why budgeting matters, and how to build a reliable system for tracking, forecasting, and improving profitability. By focusing on practical steps you can take this quarter, you can turn cash into a strategic asset that supports growth, resilience, and long-term value for your customers and team. Start with simple, repeatable processes that give you early warning of cash gaps and the confidence to act.

In the language of finance, you can think in terms of liquidity and the cash cycle—the steady stream of money in and out that keeps operations humming. Effective liquidity planning improves accounts receivable discipline, inventory turnover, and prudent use of short-term capital. Framing the topic around cash position, working capital dynamics, and forecast-informed spending helps small businesses align costs with revenue timing and growth goals. This more semantic approach captures related ideas such as cash projections, financial planning, margin optimization, pricing strategies, and capital stewardship, all of which contribute to a healthier financial runway for SMBs.

Cash Flow for Small Businesses: A Practical Guide to Forecasting, Budgeting, and Working Capital

Cash Flow for Small Businesses is the lifeblood of a company’s ability to seize opportunities, fund growth, and weather unexpected shocks. Rather than being a mere ledger line, cash flow represents the timing and reliability of incoming and outgoing funds. A healthy cash flow turns revenue into real liquidity, allowing you to invest in inventory, pay your team on time, and pursue strategic initiatives without disruption. In practice, building a reliable system starts with clear visibility: track receipts, payments, and the daily rhythms of your business so you can anticipate gaps before they become operational risks.

To turn cash flow into a strategic asset, connect it to budgeting and working capital planning. A well-structured budget functions as a forward-looking engine that aligns spending with anticipated revenue, seasonality, and payroll cycles. This tight coupling helps you decide when to accelerate a project, when to defer a purchase, and how to maintain a cash cushion for contingencies. As you implement broader working capital management for small business practices, you’ll see how disciplined cash tracking supports smoother vendor terms, more reliable supplier relationships, and a steadier path to profitability.

Cash Flow Forecasting for SMBs and Budgeting for Small Business: Strategies for Profitability and Working Capital Management

Forecasting cash flow is a disciplined exercise that translates current data into realistic scenarios. The idea is to project inflows and outflows over a horizon that matches your planning needs, then stress-test those projections against late payments, price changes, and unexpected costs. A simple model—start with opening cash, add forecasted revenues, subtract planned outlays, and adjust for seasonal patterns—can yield meaningful guidance quickly. Over time, refining the model by comparing actual cash against forecasts helps sharpen accuracy and confidence, enabling you to navigate volatility without sacrificing growth.

Beyond numbers, the goal is to integrate forecasting with budgeting for small business and implement profitability strategies that sustain cash flow. Use scenario planning to explore best-, likely-, and worst-case outcomes, so you can predefine actions for each. Leverage automation and dashboards to monitor key indicators like forecast variance, days sales outstanding, and liquidity gaps. With robust cash flow forecasting for SMBs and a practical budgeting process, you strengthen working capital management for small business—reducing days payable and optimizing inventory—so you can fund opportunities, weather shocks, and invest in long-term value creation for customers and the team.

Frequently Asked Questions

What is Cash Flow for Small Businesses and why does it matter for growth and resilience?

Cash Flow for Small Businesses refers to the timing and availability of cash coming in and going out of your operations. It matters because a positive, well-managed cash flow enables you to seize opportunities, cover obligations, and invest in growth, even when profits exist on paper. To improve it, pair solid budgeting for small business with ongoing cash flow forecasting for SMBs, track inflows and outflows, build a cash cushion, and strengthen working capital management for small business to weather seasonal swings.

How can cash flow forecasting for SMBs and budgeting for small business work together to boost profitability and manage working capital?

Cash flow forecasting for SMBs turns current data into plausible scenarios and helps you anticipate future needs. When combined with budgeting for small business, it creates a dynamic plan that aligns spending with expected revenue, supports profitability strategies, and smooths working capital management for small business. Start with the opening balance, forecast revenues and outlays, and review regularly. Use the insights to adjust pricing, negotiate terms with suppliers, manage inventory, and maintain a cash cushion so growth remains funded.

| Aspect | Key Points | Actionable Takeaways |

|---|---|---|

| Introduction | Cash flow is the lifeblood; timing and liquidity determine ability to seize opportunities or survive; cash can sit idle in invoices or be tied up in inventory. | Establish visibility; implement a tracking and forecasting system; view cash as a strategic asset this quarter. |

| Understanding Cash Flow for Small Businesses | Inflows come from sales, receivables, and financing; outflows include payroll, rent, suppliers, debt, taxes; the gap defines cash flow and reflects timing, seasonality, and cash management quality; variability often caused by late payments. | Map and monitor cash movements; plan for seasonality; build a cash buffer to reduce risk. |

| The link between cash flow and budgeting | Budgeting synchronizes planning, execution, and monitoring and should be integrated with cash flow tracking; it helps forecast next quarter/year and allocates funds to essential activities. | Develop dynamic budgets aligned to cash realities; use rolling forecasts; decide when to accelerate or delay projects. |

| Cash Flow Forecasting for SMBs | Forecasting translates data into scenarios; project inflows/outflows over weeks/months; stress-test for delays or price changes; simple model: opening balance + revenues – outlays + seasonal adjustments; track actual vs forecast; use scenario planning and digital tools. | Start with a simple model; use conservative assumptions; regularly refine forecasts based on actual results. |

| Budgeting for Small Business | Four steps: define fixed vs variable costs; forecast revenue; plan for capital expenditures; build a cash cushion; align spending with anticipated revenue; rolling forecasts beat static budgets. | Allocate working capital reserves; maintain a cash cushion; update budgets monthly. |

| Profitability and Cash Flow | Cash flow mirrors profitability; price products/services to cover costs and maintain sustainable margins; improve margins, optimize pricing, reduce waste, and boost asset utilization; pursue favorable supplier terms and value-based pricing. | Improve margins to stabilize cash; align pricing with cash needs; negotiate supplier terms to protect cash flow. |

| Working Capital Management for Small Business | Working capital funds day-to-day operations; AR: shorten terms and incentivize early payment; AP: extend terms carefully; Inventory optimization; just-in-time; accurate demand forecasting; maintain lean cushion. | Balance quick collections with relationships; maintain a lean but sufficient cushion; act quickly on opportunities. |

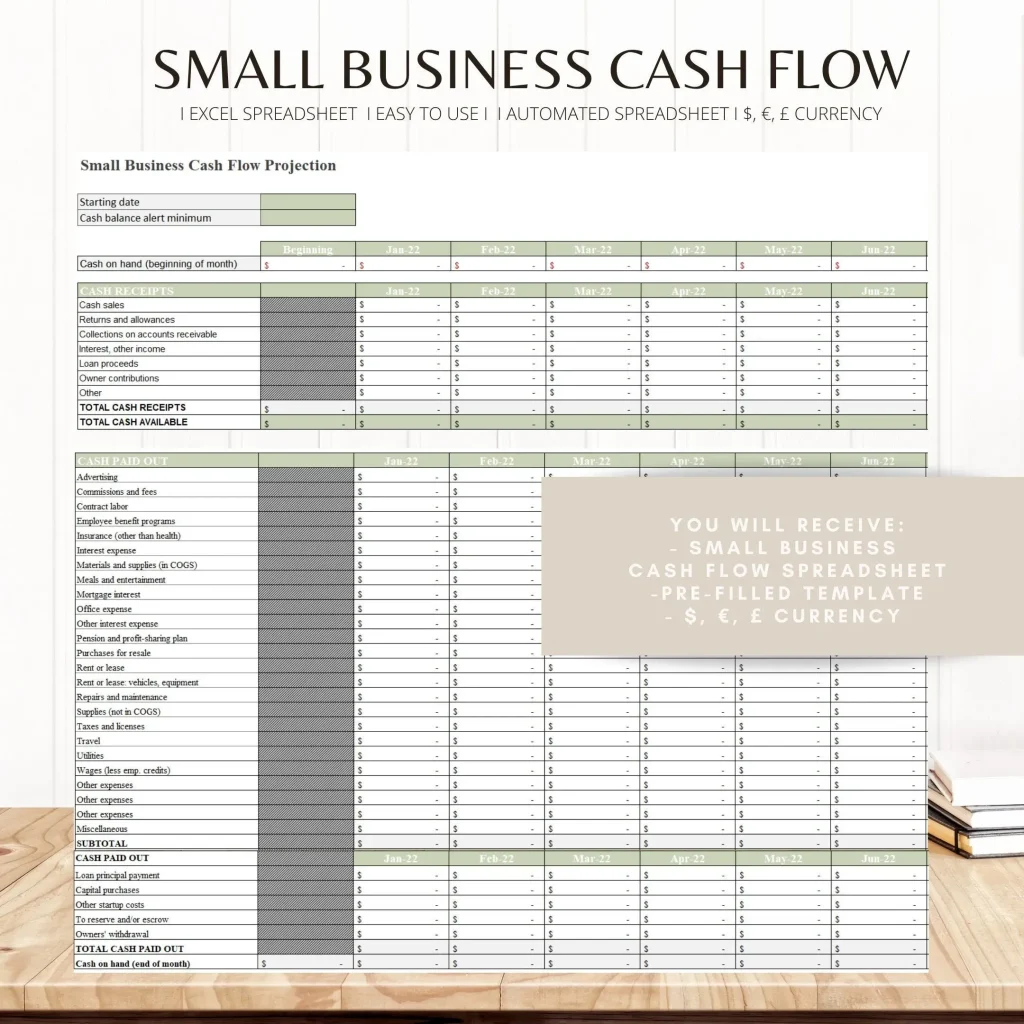

| Practical Tools and Tips | Use a real-time accounting system; dashboards for DSO, burn rate, and forecast variance; simple cash flow projections; weekly reviews; staff training; improve invoicing and procurement processes. | Automate reporting; use dashboards; establish a weekly cash review. |

| Common Mistakes to Avoid | Long payment cycles; overestimating revenue; under-budgeting for contingencies; confusing cash flow with profitability; misaligning marketing and hiring with cash reality; not updating forecasts. | Start with realistic forecasts; maintain a cash reserve; monitor vendor terms and receivables; revisit budgets regularly. |

Summary

Cash Flow for Small Businesses is the lifeblood that sustains daily operations and long-term growth. Effective management relies on clear visibility of cash inflows and outflows, disciplined budgeting, and realistic forecasting that accounts for seasonality and supplier terms. By building a robust system of monitoring, planning, and buffers, small businesses can reduce cash shortages, seize opportunities, and improve profitability. A simple, disciplined approach that aligns revenue with expenses—supported by the right tools and regular review—transforms cash flow into a strategic asset. In short, mastering cash flow empowers better decisions, strengthens customer and team relationships, and creates a more resilient path to sustainable success for your business.