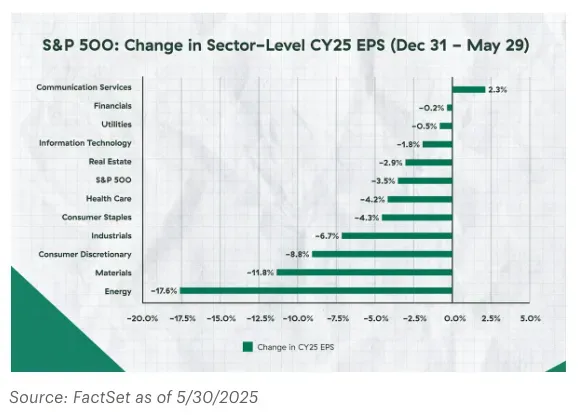

Sectors Beating Expectations are at the center of today’s market narrative, signaling resilience across the economy even as headlines spotlight volatility and a shifting policy backdrop, with investors scanning every data point for evidence that upside is durable rather than fleeting, and with portfolio managers weighing implications for asset allocation, sector rotation, and risk management amid evolving trade dynamics.As earnings seasons unfold, several industries are delivering results that surpass consensus estimates, lifting sentiment and informing strategic choices for a wide range of stakeholders, from institutional traders to corporate boards and policymakers seeking clues about the trajectory of growth, cross-border demand patterns, competitive dynamics, and regulatory signals that could alter the pace of improvement, including emerging partnerships and shifts in consumer spend.