ROI of Econmi illuminates how a data-driven platform translates into smarter decisions, faster operations, and tangible value that touches every corner of the organization—from finance and supply chain to product development and customer experience—by turning disparate information into a coherent, action-ready picture that guides strategic choices, improves governance, and aligns day-to-day work with long-term objectives. Against the backdrop of a competitive market, the narrative of ROI for Econmi highlights time saved, reduced manual work, stronger risk controls, and newfound capacity to seize opportunities, with leadership teams increasingly asking how data-driven insight translates into measurable outcomes across multiple functions and how rapid feedback loops accelerate the cycle from insight to action. To capture this return rigorously, leaders often frame ROI as a multi-faceted mix of cashable gains and measured improvements in forecasting, planning discipline, and cross-functional collaboration, along with softer but significant effects on adoption, governance, and culture that collectively raise the probability of sustainable growth. A practical lens for finance teams anchors explicit costs of ownership—licenses, integration, training, and governance—against a stream of benefits such as time savings, error reductions, forecast accuracy, inventory optimization, and revenue uplift, while recognizing that not all gains appear as direct cash inflows in the first year. With a disciplined ROI approach, organizations can translate abstract data capabilities into a compelling business case, map benefits to concrete KPIs, and communicate value iteratively to stakeholders, ensuring that the impact of Econmi is visible not only in quarterly reports but in sustained competitive advantage over time.

Beyond upfront numbers, the Econmi value story can be understood through return on investment, payback timelines, and value realization across operations. An LSI-informed framing uses terms like efficiency gains, improved decision quality, and risk reduction to illuminate the same ROI in ways that resonate with different stakeholders. In practice, decision-makers assess time to payback, total cost of ownership, and long-term value as a cohesive signal of the platform’s contribution to growth.

ROI of Econmi: Measuring the Econmi platform ROI Through Time Savings, Forecast Accuracy, and Value

Measuring the ROI of Econmi goes beyond a single figure; it’s about translating data-driven capabilities into smarter decisions, faster operations, and meaningful value. When we talk about ROI of Econmi, we’re examining time saved, improved forecast accuracy, and the agility to respond to market shifts. This aligns with the idea of measuring ROI in economics software, where the payback is not only financial but also operational and strategic—captured through a combination of cost reductions, productivity gains, and enhanced decision quality. By framing ROI as a composite story, organizations can connect every metric to tangible business outcomes and long-term value.

To truly capture the Econmi platform ROI, break down inputs into costs (licenses, integration, training, maintenance) and benefits (time savings, faster decision cycles, better forecasting, risk reduction). This approach mirrors a rigorous ROI calculation for Econmi, where the net benefits are aggregated over a defined horizon and attributed to Econmi with care to avoid double counting. Incorporating LSI-friendly concepts such as Econmi platform ROI and measuring ROI in economics software helps stakeholders understand where value originates and how it compounds as adoption matures.

Econmi impact and value: Economic software ROI analysis for data-driven decision-making

Econmi impact and value extend beyond immediate cost savings to encompass governance, data quality, and organizational agility. An effective economic software ROI analysis considers both tangible benefits—like reduced stockouts, faster cycle times, and revenue uplift—and intangible gains—such as improved collaboration, clearer ownership of data, and a strengthened data-driven culture. Presenting these elements within the Econmi impact and value framework helps leadership see how the platform contributes to strategic priorities and risk management, not just quarterly numbers.

In practice, the ROI calculation for Econmi benefits from a structured model that includes horizon selection, cost components, and measurable outputs. By mapping benefits to concrete metrics—time saved per user, forecast accuracy improvements, and reductions in inventory or compliance risk—organizations can articulate a credible economic story. This aligns with known methods in economic software ROI analysis and supports scenario testing to show how different adoption rates or cost assumptions influence outcomes, culminating in a robust ROI narrative for stakeholders.

Frequently Asked Questions

What is the Econmi platform ROI and how do you calculate ROI for Econmi?

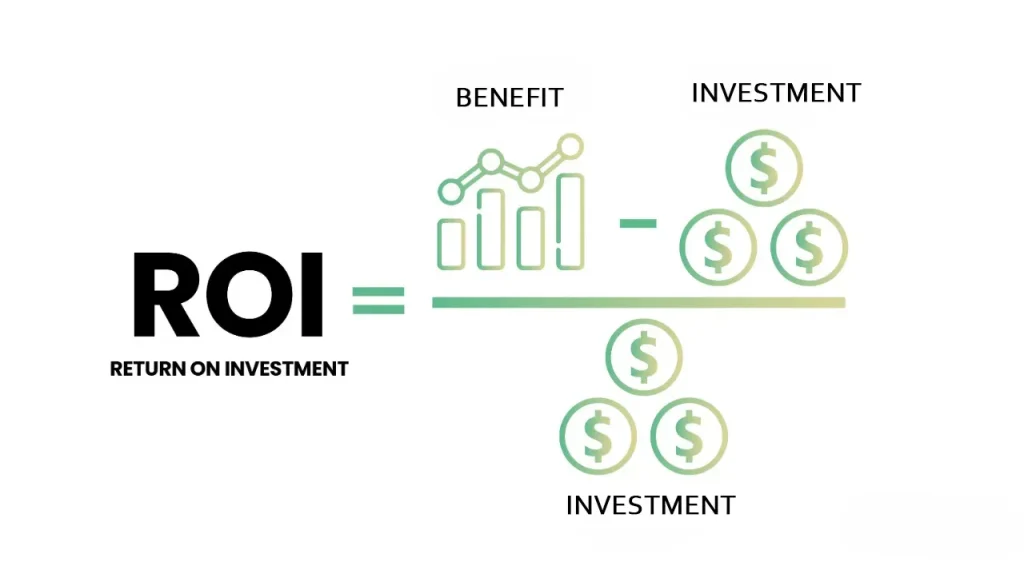

The Econmi platform ROI measures the investment’s profitability relative to its cost, blending tangible benefits (time savings, forecast accuracy, improved decision quality, risk reduction) with intangible gains (faster decision cycles, stronger data governance). Use the ROI calculation for Econmi: ROI = (Net Benefit from Econmi – Cost of Econmi) / Cost of Econmi × 100%. Start by choosing a time horizon, list all costs (licenses/subscriptions, implementation, integration, training, maintenance) and all measurable benefits (labor savings, inventory cost reductions, revenue uplift, risk avoidance), and attribute benefits to Econmi to avoid double counting. For broader insight, you can also apply payback, NPV, and IRR analyses to reflect time value and project risk.

How can organizations approach measuring ROI in economics software like Econmi to capture its impact and value?

Measuring ROI in economics software like Econmi follows a structured economics software ROI analysis. Start with a clear scope and horizon; capture all cost components (licenses, deployment, integration, training, IT effort) and catalog benefits with measurable metrics (time saved, forecast accuracy, stockouts reduced, revenue impact, risk reductions). Apply a consistent attribution approach to link benefits to Econmi, then use ROI methods such as simple ROI, payback period, NPV, IRR, and total cost of ownership, complemented by scenario analysis to show potential ranges. This framework highlights the Econmi impact and value for stakeholders and supports a credible economic software ROI analysis.

| Topic | Key Points |

|---|---|

| Introduction / Overview | ROI of Econmi translates into smarter decisions, faster operations, and tangible value. It’s a composite story of time saved, risks reduced, and opportunities unlocked; the article explains how to evaluate Econmi’s ROI with a rigorous, practical approach. |

| What is the ROI of Econmi? | ROI measures profitability relative to cost and includes both tangible financial benefits and measurable non-financial gains. It’s a framework, not a single-number snapshot, balancing cost of ownership (license, integration, training, maintenance) against benefits like time savings, forecast accuracy, decision quality, and risk reduction. |

| ROI Formula | ROI = (Net Benefit from Econmi – Cost of Econmi) / Cost of Econmi × 100% |

| Net Benefits & Costs | Net benefits include all measurable financial outcomes (increased revenue, cost reductions, productivity gains). Costs cover upfront deployment and ongoing expenses (licenses, integration, training, maintenance). Also note non-financial benefits like faster decision speed, better data governance, and employee engagement. |

| Key Drivers | Tangible: time savings/productivity, forecast accuracy/inventory optimization, cost reductions from automation, revenue uplift, risk mitigation/compliance. Intangible: faster decision cycles, adaptability, employee satisfaction/retention, competitive differentiation. |

| Measuring ROI: Framework & Data | 1) Define time horizon & scope. 2) Identify cost components (licenses, implementation, training, maintenance, internal deployment). 3) Catalog benefits with metrics (time saved per user, forecast accuracy, stockouts, decision cycle time, revenue impact, risk reduction). 4) Normalize & attribute benefits (standalone, partial attribution, time-based separation). 5) Apply financial lenses (simple ROI, payback, NPV, IRR, TCO, scenario analysis). 6) Validate with real-world data & benchmarks. |

| Practical Application: How Econmi Drives ROI | Data integration & governance reduce manual reconciliation, speed analysis, lower admin costs; Modeling automation & scenario planning shorten decision cycles; Visualization/reporting accelerates insights; Compliance & governance reduce risk and penalties. |

| Case Studies (Illustrative) | Case Study 1: Inventory optimization. Baseline: 6 hours/week on forecasts; with Econmi: 2 hours/week. 1st-year numbers: time savings $10,400; costs $16,000; net benefit -$5,600; year 2+ ROI 25–35%. Case Study 2: Demand forecasting & risk management. Baseline: stockouts; deployment reduces stockouts 20% and carrying costs 12%. 1st-year numbers: revenue $200k; cost savings $120k; license costs $40k; net benefit $280k; ROI 700%. |

| Best Practices & Pitfalls | Define clear scope & horizon; separate one-time vs recurring costs; use credible data & document assumptions; attribute benefits carefully to Econmi; include tangible and intangible benefits. |

Summary

HTML table with key points extracted from the Introduction covers ROI concepts, formula, drivers, measurement steps, practical applications, case studies, and best practices. It summarizes how Econmi’s ROI can be assessed and what factors influence its value.