A Finance Roadmap is a practical, actionable plan for turning debt into opportunity and building lasting financial freedom. Rather than chasing quick fixes, it helps you move from reactive spending to proactive saving with clear, achievable steps. This guide explains how to evaluate your finances, set milestones, and begin building toward personal autonomy in money. A core part is adopting a disciplined budgeting approach to keep you on track toward meaningful goals. The aim is to provide clarity, structure, and momentum so you can move from debt to financial independence with confidence.

Viewed from another angle, debt payoff strategies frame the journey as a sequence of deliberate actions rather than luck. This perspective aligns with a wealth-building roadmap, a personal finance strategy that prioritizes savings, risk management, and steady progress. By adopting a budgeting framework and a disciplined payment cadence, you can steadily reduce debt while laying the groundwork for future growth. In short, the path to financial freedom is built on informed decisions, ongoing learning, and a resilient plan that adapts over time.

Finance Roadmap: From Debt Payoff to Financial Freedom

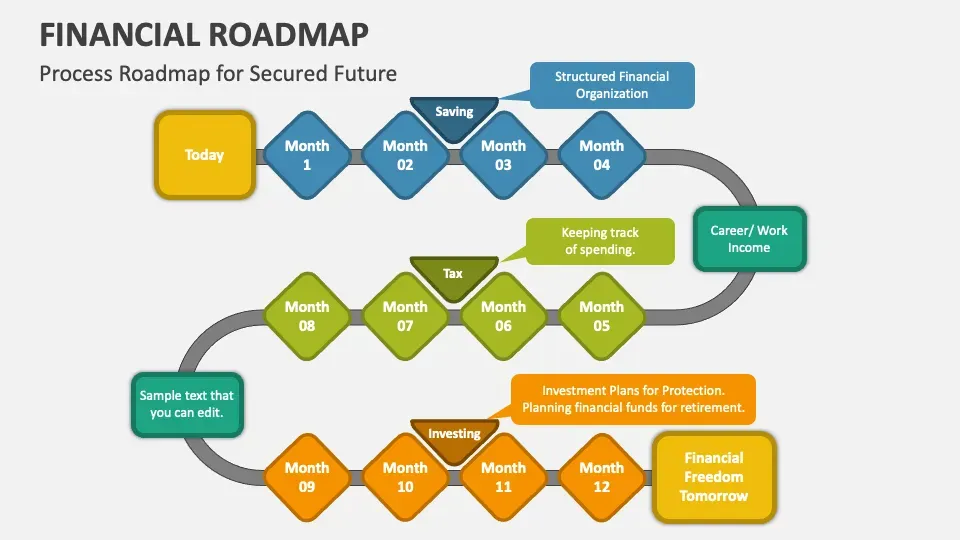

Launching your Finance Roadmap begins with a clear snapshot of where you stand. By listing total debts, monthly obligations, income, expenses, and current savings, you create a data-backed view that illuminates priorities and the next steps toward financial freedom. This is where debt payoff strategies meet a practical plan: you choose methods that fit your situation, then pair them with a robust financial freedom plan to guide your decisions every month.

The roadmap then shifts from reactive spending to proactive saving by mapping a disciplined budget for debt reduction and automating payments. A well-designed budgeting for debt reduction approach ensures a dedicated stream of cash goes toward debt while you still cover essentials. For motivation, apply debt snowball strategies on smaller balances to secure quick wins, while applying the avalanche logic to higher-interest debts when possible, all within the larger steps to financial independence.

Throughout, automation and progress tracking keep you aligned with the financial freedom plan. Regularly reviewing your numbers helps you adjust for life events and maintain momentum so the Finance Roadmap remains practical and achievable.

Debt Snowball Strategies and Budgeting for Debt Reduction on the Path to Financial Independence

Debt Snowball Strategies and budgeting for debt reduction are a powerful pair on the path to financial independence. By starting with the smallest balances, you realize wins quickly, reducing anxiety and building confidence to tackle larger obligations. While the psychological lift is real, stay mindful of interest rates to avoid paying more than necessary; a balanced approach often blends snowball wins with attention to cost.

Incorporate this into your broader Finance Roadmap by allocating every extra dollar toward debt payoff or investments after essentials are covered. The budget should clearly separate fixed costs, variable costs, and debt payments so you can see how much room exists for accelerating repayment. As your debt declines, reallocate funds toward a diversified investing strategy that supports long-term growth and advances your steps to financial independence.

Regular reviews and automation cement progress: set up automatic transfers to debt, savings, and retirement accounts; monitor progress with simple metrics; and adjust for life changes, so your debt payoff journey remains sustainable and aligned with your ultimate goal of financial independence.

Frequently Asked Questions

What is a Finance Roadmap and how can it support debt payoff strategies and a financial freedom plan?

A Finance Roadmap is a practical, actionable plan for turning debt into opportunity and building lasting financial freedom. It starts with a clear snapshot of your finances and then applies debt payoff strategies (avalanche, snowball, or a hybrid) while following budgeting for debt reduction to allocate funds toward debt and savings. It aligns with a financial freedom plan by setting specific, time-bound milestones—such as eliminating high-interest debt, building an emergency fund, and starting to invest—so progress stays tangible. Regular automation, progress tracking, and periodic reviews keep you on track toward financial independence.

How do debt snowball strategies fit into the Finance Roadmap and the steps to financial independence?

Debt snowball strategies build momentum by paying off the smallest balances first, creating quick wins within the Finance Roadmap. Within a Finance Roadmap, debt snowball strategies are a core debt payoff strategy that can drive motivation, especially when paired with attention to interest rates (a hybrid with debt avalanche). As you progress, the roadmap carries you through the steps to financial independence by preserving cash flow for an emergency fund, disciplined saving, investing for long-term growth, and building financial literacy. Automation and regular progress reviews help you adapt to life changes while staying on track toward financial independence and a durable financial freedom plan.

| Aspect | Key Points |

|---|---|

| Finance Roadmap concept | A practical, actionable plan to turn debt into opportunity and build lasting financial freedom. |

| Starting point | Begin with a clear snapshot of finances (debts, income, expenses, savings); compute net worth; set milestones. |

| Define financial goals | Include emergency fund, credit health, retirement, safeguards; goals should be specific, time-bound, and adaptable. |

| Assessing current financial health | Three steps: net worth, cash flow, debt categorization by interest and payoff priority; data-driven view. |

| Debt payoff strategies | Avalanche and snowball methods; hybrid options; automate payments; maintain consistency; avoid new debt. |

| Budgeting for debt reduction | Use structured budgeting (50/30/20 or debt-focused); map fixed/variable costs; allocate to debt; automate transfers; channel extra income to debt/investments. |

| Building a financial freedom plan | Emergency fund (3–6 months), repayment schedule, diversified investing; set target date and milestones; reallocate funds post-debt. |

| Steps to financial independence | Save and invest early; use tax-advantaged accounts; compound over time; ongoing financial education. |

| Automation and progress tracking | Automatic transfers; budget tracking; regular reviews (monthly then quarterly); adapt to life changes. |

| Preparing for life events | Emergency fund, insurance coverage, contingency plans; risk management; long-term horizon. |

| Behavioral habits | Small daily choices, automation of savings, tracking spending; discipline and sustainable routines. |

| Additional considerations | Credit health, insurance adequacy, tax efficiency; optimize utilization; align with long-term goals. |

Summary

Finance Roadmap is a practical, repeatable process for moving from debt to financial freedom. By starting with a clear assessment, selecting effective debt payoff strategies, and crafting a durable financial freedom plan, individuals set themselves up for long-term success. The journey requires patience, discipline, and steady progress, but each small step compounds into meaningful results over time. Focusing on understanding finances, automating disciplined payments toward debt reduction, and investing for the future helps reduce stress and unlock opportunities to live in line with personal values. The path from debt to freedom is not a mystery—it is a plan you build, refine, and live by every day.