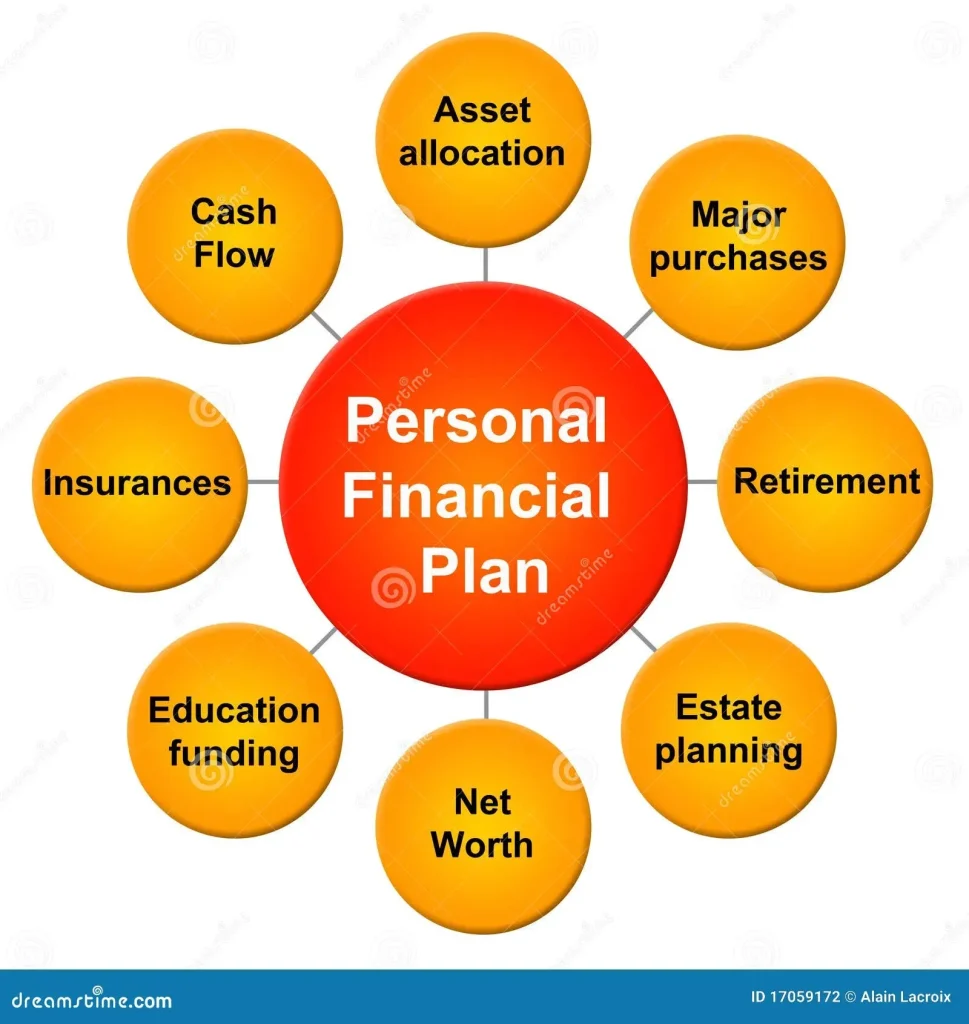

A solid Personal Finance Plan acts as a clear compass in today’s changing financial landscape. This framework emphasizes practical steps you can rely on year after year rather than rigid rules, helping you build confidence and momentum. A plan designed for 2025 accounts for shifting costs, changing income, and evolving priorities while staying simple to maintain, with periodic reviews. It translates big ambitions—like buying a home or funding education—into doable, measurable actions that you can track over time. Including a debt payoff plan helps you reduce interest costs and frees up money for savings, while preserving flexibility for unexpected expenses.

Viewed through a broader lens, this topic can be framed as a personal money-management strategy, a budgeting blueprint, or a long-term financial roadmap for 2025 and beyond. It blends planning, discipline, and flexibility to adapt to income changes, inflation, and life events. In practice, this approach starts with a clear assessment of earnings and obligations, then shapes saving strategies, debt reduction tactics, and investment steps into a cohesive plan. The emphasis is on consistent habits, transparent tracking, and decisions that align with your values and future goals.

The Personal Finance Plan: A Clear Path to Budgeting for 2025

In today’s changing economy, a Personal Finance Plan acts as a living blueprint that guides decisions about spending, saving, debt, and investing. It ties budgeting for 2025 to longer-term aims and adapts as costs shift and income changes. A well-crafted plan translates aspirational goals—such as homeownership, education funding, or security—into doable steps and milestones, while staying simple enough to maintain month after month. This aligns with broader financial planning for 2025, ensuring your approach remains relevant to inflation, tax changes, and new tools.

To start, map your baseline: income, expenses, debts, and savings. Set SMART goals that include saving goals 2025, retirement readiness, and education funds. Choose a budgeting method you’ll actually follow—zero-based budgeting, 50/30/20, or the envelope method—and automate transfers to savings and investments so progress stays consistent. The aim is clarity and momentum, not perfection.

Debt payoff plan and Saving goals 2025 within Financial planning for 2025

A Debt payoff plan is a cornerstone of any solid 2025 strategy. List every balance by interest rate, decide on avalanche or snowball, and weave debt payments into your monthly budget. Consider refinancing or consolidation where it reduces costs, and view debt payoff as a lever that frees cash for saving and investing, aligning with a broader financial planning for 2025.

Saving goals 2025 should be treated as a core component of your long-term strategy. Prioritize an emergency fund of three to six months of essential expenses, automate ongoing contributions, and segment funds for short- and long-term targets (vacations, large purchases, or retirement). Leverage tax-advantaged accounts and a diversified investment plan to protect purchasing power, while keeping a mindful eye on inflation and risk tolerance within your financial planning for 2025.

Frequently Asked Questions

How does a Personal Finance Plan improve Budgeting for 2025?

A Personal Finance Plan acts as a living framework that aligns your income, expenses, and priorities, making Budgeting for 2025 practical and consistent. It helps you choose a budgeting method (such as zero-based, 50/30/20, or envelope) and automate transfers to savings and debt payments, while accounting for inflation. This approach keeps spending in check month to month and ties budget decisions to your SMART goals for the year.

What role does a Debt payoff plan and Saving goals 2025 play in Financial planning for 2025?

In Financial planning for 2025, a Debt payoff plan is a core strategy that focuses on reducing high‑interest debt while preserving cash flow for saving and investing. When paired with Saving goals 2025, it supports building an emergency fund and reaching short-term targets as part of a cohesive plan. You can choose avalanche or snowball methods and routinely consider refinancing or consolidation when beneficial, all within a structure you review regularly.

| Key Point | Description | Notes / 2025 Focus |

|---|---|---|

| Introduction to Personal Finance Plan for 2025 | A flexible framework for managing money, updated for 2025’s shifting costs and income. | Emphasizes simplicity and consistency; designed to adapt month to month. |

| What is a Personal Finance Plan and why it matters in 2025 | A living blueprint that combines budgeting, saving, debt management, investing, and risk protection. | Accounts for inflation, evolving tax rules, and digital tools; goals become actionable steps. |

| Step 1 – Assess your current financial picture | Snapshot of income, expenses, debts, savings, and investments; build a simple balance sheet and cash-flow view. | Baseline for 2025 budgeting; identify optimization opportunities. |

| Step 2 – Define SMART goals for 2025 | Specific, Measurable, Achievable, Relevant, Time-bound goals; track monthly. | Examples include saving targets and debt payoff milestones. |

| Step 3 – Design a budget for 2025 | Choose a budgeting method such as zero-based, 50/30/20, or envelope; automate transfers and bills. | Include inflation adjustments in essentials. |

| Step 4 – Build an emergency fund | Target 3 to 6 months of essential expenses; start with 1 month; automate contributions; separate short term savings. | Prepares for life changes and unexpected costs. |

| Step 5 – Create a debt payoff plan | Hybrid approach: avalanche or snowball; integrate into budget; consider refinance or consolidation. | Accelerates financial momentum and frees up cash for saving. |

| Step 6 – Save and invest for the long term | Prioritize retirement accounts, tax advantaged accounts, and diversified investing; automate and rebalance. | Long term growth with risk management. |

| Step 7 – Protect what you have | Review health, life, disability, auto, home, and liability coverage. | Adequate protection reduces risk of derailing goals. |

| Step 8 – Plan for taxes | Understand your tax bracket; maximize deductions and credits; time income and deductions. | Tax aware planning improves take home results. |

| Step 9 – Estate planning basics | Wills, beneficiaries, healthcare directives, and power of attorney. | Keeps resources secure for loved ones. |

| Step 10 – Review cadence | Regular monthly or quarterly reviews; adjust for life events; refine goals. | Ensures alignment with reality and milestones. |

| Tools, templates, and practical tips | Budget templates, debt payoff calculator, one page snapshot, reminders, accountability or advisor support. | Make the plan stick with practical aids. |

| Common pitfalls to avoid in 2025 | Overly optimistic assumptions, automation gaps, inflation neglect, updating beneficiaries, and rebalancing. | Be proactive; build resilience against missteps. |

| 2025 budget tips to reinforce your plan | Build a baseline with inflation, prioritize high impact savings, automate transfers, review subscriptions, re-evaluate goals. | Optimize ongoing performance of the plan. |

Summary

Personal Finance Plan for 2025 is about purposeful choices, consistent action, and a flexible framework you can adapt as life evolves. By starting with a clear assessment, setting SMART goals, designing a practical budget for 2025, building an emergency fund, implementing a debt payoff plan, and committing to saving and investing, you create financial momentum that compounds over time. Regular reviews, smart risk management, and tax-aware decisions further strengthen your plan, helping you achieve the financial outcomes you want. With patience and persistence, your Personal Finance Plan becomes a reliable navigation tool through the complexities of 2025 and beyond.