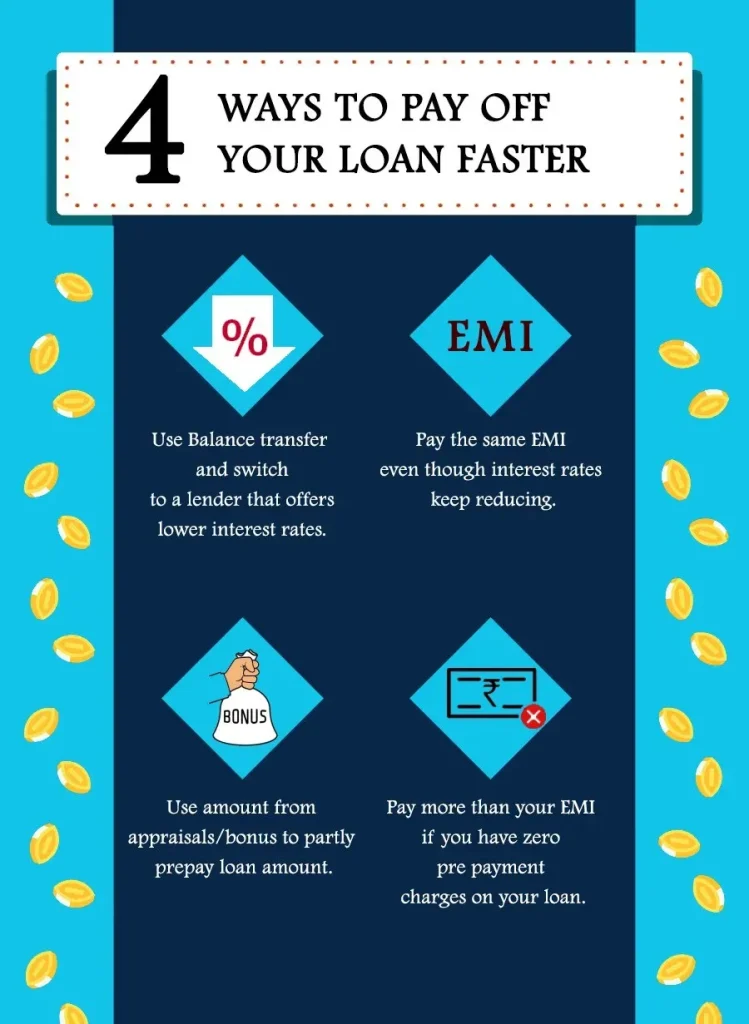

Debt to Wealth is not a fairy-tale outcome; it’s a practical framework that reframes debt as a temporary hurdle rather than a permanent obstacle, turning fear into a deliberate, measurable pathway for long-term prosperity through steady, repeatable actions that you can track, adjust, and improve as your income, goals, and responsibilities evolve over time, supported by simple rituals like monthly net worth checks and milestone celebrations. By pairing proven debt payoff strategies with a clearly defined personal finance plan, you create a road map that not only makes complex bills easier to understand but also translates into a sequence of concrete steps—such as prioritizing high-interest balances, negotiating terms where possible, and redirecting windfalls toward principal—so you can attack debt with consistency and confidence. This approach embraces budgeting for beginners and weaves in wealth-building habits, so small, disciplined adjustments—like trimming discretionary spending, automating transfers to savings and debt payments, and reviewing subscriptions on a quarterly basis—compound into meaningful changes over time and help you cultivate a resilient financial routine, and by keeping a running log of expenses, savings, and debt reductions you not only see progress more clearly but also learn what behaviors most reliably push you toward your goals, reinforcing a positive feedback loop that makes financial discipline feel natural. The payoff isn’t just eliminating debt; it’s restoring financial freedom, building a prudent reserve, and opening doors to sustainable investing and future opportunities by teaching you to live within your means, plan for contingencies, and view money as a tool for growth rather than a source of stress. If you commit to the plan, monitor progress with quarterly reviews, seek feedback when needed, and stay adaptable as life shifts—whether through changes in income, family needs, or market conditions—you’ll transform debt into a durable foundation for growth and begin to see your goals crystallize into tangible milestones, with this ongoing learning process also inviting accountability from peers or mentors, which helps sustain momentum.

Think of debt as a temporary mortgage on tomorrow’s possibilities, and see a path where disciplined spending, strategic saving, and smart investing work together to grow your net worth. This broader angle reframes the journey as a financial independence plan that blends debt reduction with income growth, careful budgeting, and habit-building. By emphasizing sustainable money habits, you create a resilient personal finance strategy that supports both short-term relief and long-term wealth.

Debt to Wealth: A Practical Personal Finance Plan to Eliminate Debt and Build Wealth

Debt to Wealth isn’t a dream; it’s a structured path from debt to sustained wealth guided by a practical personal finance plan. By tying everyday spending to longer-term goals, you can begin moving money from interest payments to investments that compound over time.

This approach blends proven debt payoff strategies with a clear personal finance plan. You’ll learn how to prioritize high-interest balances, create predictable payoff milestones, and build wealth-building habits that support financial freedom. The result is a repeatable system that turns small, steady steps into meaningful long-term progress.

As you implement the plan, you’ll also adopt budgeting for beginners-friendly practices—automation, simple tracking, and habit formation—that reduce friction and keep you on course toward financial freedom and a stronger net worth.

Budgeting for Beginners: Structured Steps to Financial Freedom and Wealth-Building Habits

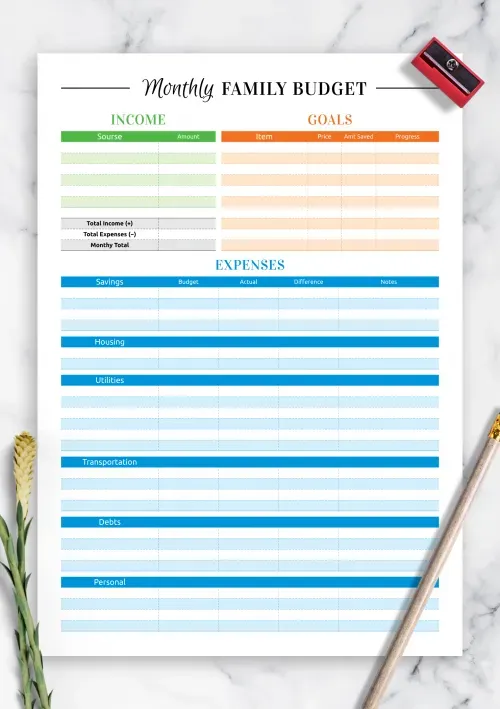

Budgeting for beginners is less about restriction and more about clarity and control. A simple framework—such as allocating 50% to needs, 30% to wants, and 20% to savings and debt payoff—gives you a concrete path toward a personal finance plan that supports you, not against you.

With budgeting for beginners in place, you can start building wealth-building habits: setting automatic transfers to savings and investments, tracking discretionary expenses, and ensuring every dollar serves a purpose. These practices create financial momentum and bring you closer to financial freedom.

Along the way, integrating debt payoff strategies—whether snowball or avalanche—into your budget ensures that progress toward debt reduction accelerates as your income grows. This alignment of budgeting, debt repayment, and wealth-building habits forms a resilient foundation for long-term financial security.

Frequently Asked Questions

How can Debt to Wealth be achieved through proven debt payoff strategies and a solid personal finance plan?

Debt to Wealth blends proven debt payoff strategies (snowball and avalanche) with a practical personal finance plan. Start by assessing your starting point (net worth, monthly cash flow, debt inventory), then select a debt payoff method that fits you. Keep minimum payments on all debts and direct extra funds to the prioritized debt. Build a simple personal finance plan that includes an emergency fund, a realistic budget, and a path to investing. With consistent, small improvements, you move from debt payoff to wealth-building and financial freedom.

What budgeting for beginners steps and wealth-building habits are essential in the Debt to Wealth framework to reach financial freedom?

In the Debt to Wealth framework, budgeting for beginners means creating a clear, controllable plan that aligns spending with goals. Use a simple approach (like 50/30/20 or zero-based budgeting) and automate transfers to savings and debt payments. Pair this with wealth-building habits such as automatic investing, regular financial check-ins, and continuous learning. As debt declines, also focus on income growth and smart protection (insurance and estate planning) to steadily progress toward financial freedom and lasting wealth.

| Section | Key Points | Practical Takeaways |

|---|---|---|

| Introduction |

|

|

| Step 1: Understand Your Starting Point |

|

|

| Step 2: Prioritize and Plan Debt Payoff (Debt Payoff Strategies) |

|

|

| Step 3: Build a Realistic Budget (Budgeting for Beginners) |

|

|

| Step 4: Establish an Emergency Fund (A Safety Net for Financial Freedom) |

|

|

| Step 5: Increase Income and Maximize Earnings Potential |

|

|

| Step 6: Invest for Growth (Turning Debt-Lue toward Wealth-Building) |

|

|

| Step 7: Protect Your Wealth (Insurance, Estate, and Financial Planning) |

|

|

| Step 8: Track Progress and Adjust (The Longevity of Debt to Wealth) |

|

|

| Step 9: Adopt Wealth-Building Habits (Consistency is Key) |

|

|

Summary

Debt to Wealth is a practical, step-by-step framework for turning debt into lasting wealth through disciplined budgeting, debt payoff strategies, and wealth-building habits. The plan emphasizes small, consistent actions that compound over time, pairing prudent budgeting with intentional investing and income growth. By following the nine steps—understanding your starting point, selecting a debt payoff strategy, building a budget, establishing an emergency fund, increasing income, investing for growth, protecting wealth, tracking progress, and cultivating wealth-building habits—you can progress toward financial freedom. This descriptive overview outlines how disciplined execution and adaptability help transform debt into sustainable wealth. With a focus on practical actions for debt payoff strategies, budgeting for beginners, and wealth-building habits, Debt to Wealth guides readers toward security, opportunity, and long-term financial freedom.