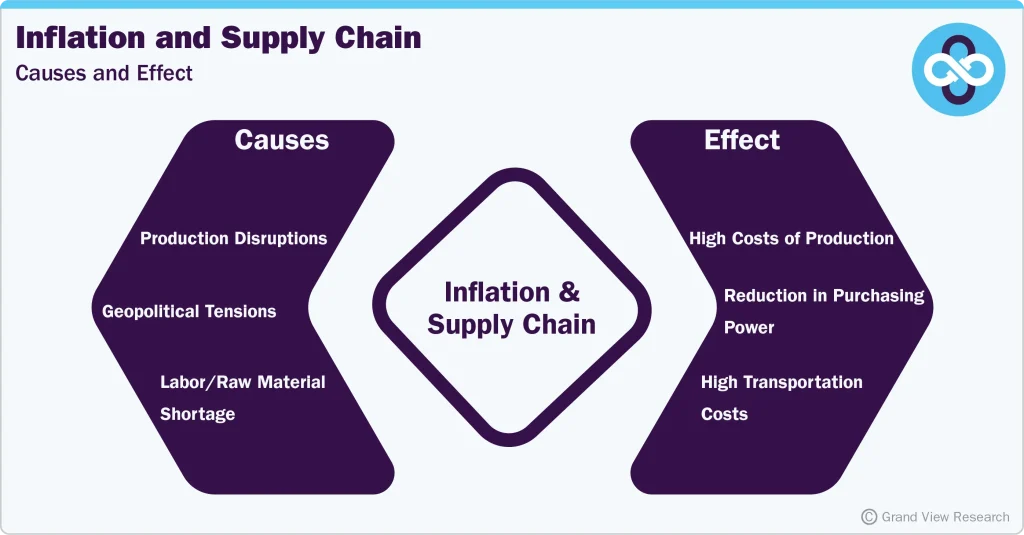

Supply chain and inflation are two of the most pressing forces shaping modern business. As inflation effects on supply chain become evident in everything from raw materials to freight and warehousing costs, leaders see how interconnected costs are. This dynamic tests supply chain resilience, highlights cost pressures in logistics, and forces a pricing strategy in inflationary times. Disruptions such as global supply chain disruptions amplify volatility, complicating planning and forecasting. Leaders must translate insights into actions that protect margins, maintain customer trust, and fuel growth.

From a Latent Semantic Indexing (LSI) perspective, the topic centers on rising input costs and fragile logistics networks that ripple through sourcing, production, and delivery. In practice, firms think in terms of price volatility, procurement risk, and margin pressure rather than a single inflation headline. Other semantically related terms include cost inflation in supply chains, supply network fragility, and disruption risk, all pointing to the same fundamental challenge. Effective responses blend visibility, supplier diversification, demand shaping, and disciplined pricing to maintain service levels and profitability.

Supply chain and inflation: Navigating cost pressures and pricing strategy in inflationary times

Inflation reshapes every cost line in procurement and logistics. Materials, components, energy, wages, and freight move with macro pressure, creating broad cost pressures in logistics. When inflation effects on supply chain intensify, leaders must map cost trajectories across sourcing, production, and delivery, and translate those insights into actions that protect margins, safeguard service levels, and preserve customer value.

To translate insight into durable outcomes, adopt a pricing strategy in inflationary times that reflects shifting input costs and demand elasticity. Build a value-focused narrative with customers, renegotiate terms with key suppliers, and align finance, procurement, and pricing teams around a shared objective. This integrated approach treats supply chain and inflation as a single, actionable discipline rather than isolated forces.

Building supply chain resilience in a volatile world: strengthening resilience amid global disruptions and cost pressures

Building supply chain resilience requires diversified supplier bases, regional sourcing, and clear escalation protocols to blunt the impact of global supply chain disruptions. By broadening supplier risk footprints and fostering collaborative agreements, companies reduce single-source vulnerability and improve responsiveness during volatility.

Equally important is investing in digital visibility, demand forecasting, and scenario planning to anticipate inflation shocks and cost pressures in logistics. Real-time analytics, supplier performance dashboards, and agile inventory policies enable faster, data-driven decisions that protect service levels while preserving margins, even as the macro environment shifts.

Frequently Asked Questions

How do supply chain and inflation interact to drive costs and shape pricing strategy in inflationary times?

Supply chain and inflation raise the cost base across materials, labor, energy, and transportation, and disruptions magnify price volatility. Inflation effects on the supply chain can also be magnified by currency moves and commodity swings. To protect margins, adopt a pricing strategy in inflationary times that links prices to input costs and demand elasticity, with dynamic pricing, selective cost pass-through, and transparent communication. Strengthen resilience through better visibility, scenario planning, supplier diversification, and optimized inventory to cushion shocks.

What steps can improve supply chain resilience amid global supply chain disruptions and rising logistics costs?

Key actions include diversifying and regionalizing suppliers to reduce concentration risk, nearshoring where feasible, and establishing clear escalation clauses in contracts to manage inflation. Build stronger supplier collaborations and long-term agreements with price escalation terms. Maintain prudent safety stock to mitigate stockouts and address cost pressures in logistics. Invest in digital visibility and analytics for demand, inventory, and transport costs, and apply scenario planning to stress-test inflation and disruption scenarios. Complement with hedging where appropriate and ensure clear risk governance with defined ownership of response activities.

| Key Point | What It Means | Implications |

|---|---|---|

| Intersection of Supply Chain and Inflation | Inflation changes the cost structure of every business function and interacts with supply chain disruptions; resilience becomes critical; the relationship is bidirectional—inflation can magnify costs, while a robust supply chain can mitigate some shocks. | Requires strategic foresight and tactical discipline; alignment across procurement, operations, and finance; emphasis on risk management and scenario planning. |

| Costs and pricing pressures | Persistent inflation drives higher costs for materials, labor, energy, and transport; frequent price updates and renegotiations become necessary. | Balance price increases with demand sensitivity; protect margins while maintaining customer loyalty. |

| Inventory and working capital dynamics | Inflation can push toward leaner or precautionary inventories; higher carrying costs and obsolescence risk. | Recalibrate demand forecasting, safety stock, and reorder points; use scenario planning to optimize working capital. |

| Supplier risk and diversification | Inflation highlights supplier vulnerabilities and concentration risk. | Diversify supplier base, regionalize, establish escalation clauses, and foster collaboration to spread cost pressures. |

| Customer demand and pricing strategy | Rising prices influence consumer behavior; require analysis of price elasticity and value proposition. | Dynamic pricing, promotions aligned with demand cycles, and flexible contracts to preserve demand and margins. |

| Operational efficiency and technology gains | Efficiency investments (visibility, forecasting, AI optimization) yield ROI by reducing waste and lead times. | Invest in digital tools, enable real-time adjustments, and use analytics to respond quickly to price changes and disruptions. |

| Strategies to Build Resilience | A set of methods to weather inflation and sustain profitability. | – Diversify and regionalize supply networks – Implement dynamic and transparent pricing – Optimize inventory with advanced analytics – Forge supplier collaborations and long-term agreements – Invest in digital visibility and analytics – Prudent hedging and financial planning – Scenario planning and risk governance |

| Industry Perspectives | Different sectors experience inflation differently; agility is key. | Manufacturers, retailers, and service providers must reconfigure suppliers, pricing, and operations while maintaining customer trust. |

| Metrics to Track | Quantitative measures to monitor inflation readiness. | – Cost per unit – Inventory turnover and days of inventory on hand – Lead time and on-time delivery – Price realization and elasticity – Supplier risk scores and diversification metrics – Working capital and cash conversion cycle |

Summary

Supply chain and inflation interact in complex ways that shape costs, pricing, and risk across industries. By embracing diversification, strategic pricing, inventory optimization, supplier collaboration, and digital visibility, organizations can navigate inflationary periods while sustaining growth and margins. Proactive planning, clear metrics, and cross-functional alignment are the backbone of resilience—test scenarios, monitor key indicators, and continuously adapt to the evolving macro environment.