Economic Policy and Politics shape how a nation translates collective goals into real outcomes. When policymakers debate taxes, design budgets, or set growth targets, they influence incentives and the distribution of opportunity. Understanding these interdependencies helps citizens, investors, and analysts anticipate policy moves and evaluate trade-offs in fiscal policy and tax reform debates. This topic matters for living standards, job creation, and resilience during shocks, linking everyday life to broader fiscal choices. By unpacking how taxes, budgets, and growth interact, we can see how revenue decisions shape the economy and society.

To approach this topic through a different lexicon, think in terms of public finance strategy, revenue allocation, and macroeconomic stewardship. The discussion remains anchored in budgets and tax policy, but LSI principles encourage linking governance quality, incentives, and long-run growth behind the numbers. LSI-friendly terms like fiscal discipline, revenue reform, and investment-driven growth capture the same ideas from a broader semantic field. By tying policy design to institutions, accountability, and political economy, readers can map choices to living standards and resilience.

Economic Policy and Politics: Taxes, Budgets, and Growth under Fiscal Policy

Economic Policy and Politics frames how a society translates goals into outcomes through fiscal policy. In this view, taxes are the primary revenue tool that funds public goods and services, shapes incentives, and influences distribution. Budgets convert that revenue into infrastructure, health, education, and social protection, while growth depends on a stable macroeconomic backdrop, credible policy, and productive investment. Together, taxes, budgets, and growth define the policy space in which governments act and citizens respond.

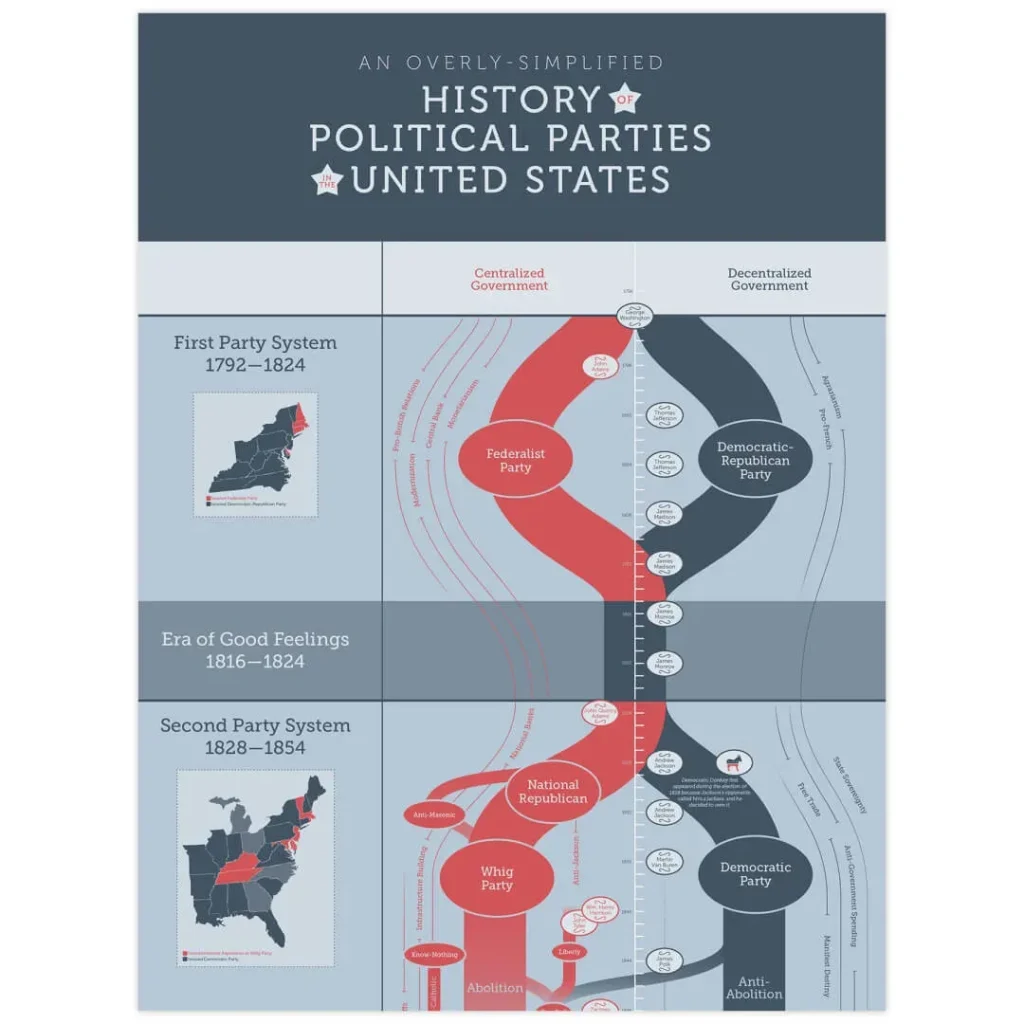

The political process shapes tax policy far beyond pure economics. Partisan divides, coalitions, public opinion, and institutional rules determine which tax bases are broadened, how rates are set, and what exemptions exist. Tax reform efforts—whether aimed at simplification, fairness, or competitiveness—become protracted political projects because stakeholders from small businesses to multinational firms and households care deeply about the consequences for revenue and incentives. Designing tax policy thus matters for both equity and efficiency within the broader fiscal policy framework.

Tax Reform and Fiscal Policy: Navigating Budgets for Sustainable Growth

Tax reform and fiscal policy are tightly interwoven in the quest for sustainable growth. Expanding the tax base or adjusting rates changes revenue stability, distribution, and economic behavior, while budgets determine whether those gains are invested in productive capital or consumed in the short run. A sound reform approach considers growth-enhancing investments, such as infrastructure and human capital, and how tax incentives affect private-sector activity, all within a framework of fiscal policy that aims to balance immediate needs with long-term sustainability.

The political economy of fiscal policy emphasizes who pays, who benefits, and who bears the costs of reform. Credible budget rules, independent fiscal institutions, and transparent auditing help ensure that tax reform and spending decisions translate into real improvements in living standards. When deficits arise, they must be weighed against debt sustainability and market confidence; when reforms are pursued, they should align with growth objectives while maintaining equity and efficiency. In this light, fiscal policy becomes a disciplined pathway to growth rather than a episodic political contest.

Frequently Asked Questions

How does fiscal policy in Economic Policy and Politics affect taxes, budgets, and growth?

Fiscal policy in Economic Policy and Politics uses government spending and taxation to influence aggregate demand, investment, and employment. Tax changes affect incentives and revenue, while budgets determine the level and composition of public investment and services, shaping growth and debt dynamics. Credible rules and transparent governance help ensure policy reliability and minimize policy-induced volatility. In short, taxes, budgets, and growth are closely connected within the political economy of Economic Policy and Politics.

Why is tax reform central to Economic Policy and Politics when balancing budgets and promoting sustainable growth?

Tax reform in Economic Policy and Politics aims to broaden the tax base, improve equity, and stabilize revenue to support essential budgets and public investment. The reform process must consider growth outcomes, budget constraints, and who bears the costs or gains, reflecting the political economy behind policy changes. Trade-offs include short-term relief versus long-run sustainability and potential effects on investment and employment. Ultimately, successful tax reform aligns revenue stability with growth-friendly budgets and credible governance in Economic Policy and Politics.

| Theme | Key Points | Impact / Notes |

|---|---|---|

| Taxes | Primary revenue tool; shapes incentives and distribution; progressive vs flat structures; political dynamics influence bases, rates, exemptions | Influences equity, growth, and policy feasibility. |

| Budgets | Translate revenue into public spending; debt management; deficits can stimulate demand or signal sustainability; allocation vs. current consumption | Political choices determine growth impact and credibility. |

| Growth | Depends on macro stability, investment, business environment; fiscal policy interacts with monetary policy; timing and targeting matter | Policy design affects productivity and living standards. |

| Political Economy | Who pays, who benefits; lobbying; reform durability; credibility and implementation | Policies reflect priorities and power relations. |

| Institutional Design | Fiscal rules, budget offices, transparency; credible commitments; governance across electoral cycles | Strengthens or weakens policy effectiveness. |

| Case Contexts | Advanced vs emerging economies show different trade-offs and priorities in tax and budget decisions | Context matters for effectiveness of reforms. |

| Practical Takeaways | Transparency, growth-oriented investment, balance between equity and efficiency, institutional credibility, awareness of political cycles | Guides citizen and policymaker actions. |

Summary

HTML table presenting key points about Economic Policy and Politics, focusing on taxes, budgets, growth, political economy, and governance.