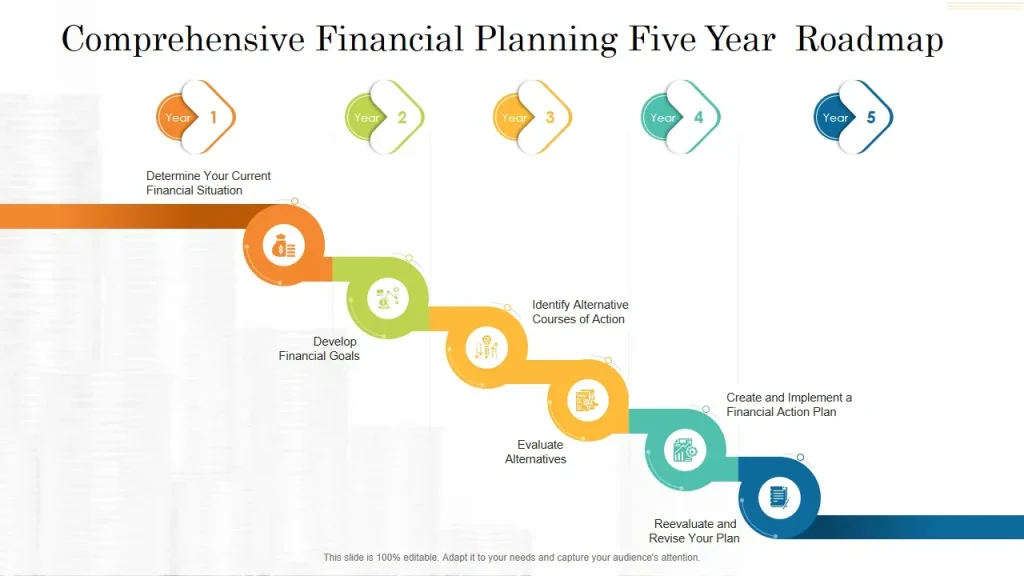

The Practical finance roadmap you follow begins with clear, realistic steps to master money management and build momentum. It anchors every step in budgeting basics, helping you map income, track expenses, and preserve capital for what matters most. With this structure, you’ll progress through saving strategies to investment planning for beginners, turning a personal finance roadmap into daily practice. A disciplined approach emphasizes building an investment portfolio gradually, using small, repeatable actions that compound over time. By focusing on goals, consistency, and realistic milestones, you’ll reduce money stress and gain confidence to adapt when life changes.

From another angle, this journey reads as an actionable financial plan that guides you from everyday spending to purposeful investing. Think of it as a step-by-step money-management path and a practical blueprint for building wealth through regular saving. Alternative terms you might encounter include a wealth-building framework, a budgeting-to-investing transition, or a prudent financial-wellness roadmap. Using these related terms reinforces meaning for readers and helps search engines connect related ideas such as cash flow, debt reduction, and asset allocation.

Practical finance roadmap: A structured path from budgeting basics to investing

Embarking on money management begins with budgeting basics. By tracking all sources of income and every expense, you create the foundation for a disciplined personal finance roadmap and a solid emergency fund. Saving strategies—especially automatic transfers and deliberate cost cutting—turn small, repeatable actions into momentum over time, reducing money stress and widening your available capital for future investing.

With cash flow under control, you can start investment planning for beginners. Define your time horizon and risk tolerance, then translate those factors into a simple asset allocation plan. A core-satellite approach—low-cost index funds for the core with selective satellite positions—lets you practice investment planning for beginners while building an investment portfolio that can weather market cycles and support long-term goals. Regular rebalancing and tax-aware choices amplify your progress within your personal finance roadmap.

Smart saving to portfolio: steps for building an investment portfolio

Saving strategies stay central as you move toward investing, using automation and a well-structured emergency fund to fund future opportunities. Automate contributions to a high-yield savings account, and align them with payday to build capital without constant willpower. This is where budgeting basics and a clear personal finance roadmap intersect, helping you stay consistent even when markets are volatile.

Constructing a portfolio means choosing breadth and balance. Start with broad-market indices as a durable core and add satellite holdings that reflect your interests and growth opportunities. This disciplined approach supports building an investment portfolio that adapts to life changes and aligns with an ongoing investment planning for beginners, ensuring you maintain diversification, liquidity, and cost awareness while pursuing your long-term wealth goals.

Frequently Asked Questions

What is the Practical finance roadmap and how do budgeting basics lead to investment planning for beginners?

The Practical finance roadmap is a practical, step-by-step guide that starts with budgeting basics and moves toward investing. By mastering budgeting basics, you map income and expenses, build an emergency fund, and apply saving strategies to grow your savings. With a solid foundation, you can begin investment planning for beginners and start building an investment portfolio that fits your goals, time horizon, and risk tolerance.

How can I progress from budgeting basics to building an investment portfolio within a personal finance roadmap?

Following the Practical finance roadmap, complete budgeting basics, establish an emergency fund, and reduce high-interest debt; then use saving strategies to fund an investment plan. In investment planning for beginners, define your time horizon, risk tolerance, and asset allocation, and implement a core-satellite approach to building an investment portfolio. Regular rebalancing and periodic goal reviews keep your personal finance roadmap on track.

| Section | Key Points |

|---|---|

| Introduction |

|

| Budgeting Basics: Establishing a Foundation |

|

| Emergency Fund and Debt: Solidifying the Base |

|

| Saving Strategies: Making Your Money Work |

|

| Investment Planning for Beginners: From Intent to Allocation |

|

| Building a Portfolio: Constructing a Solid Core |

|

| Putting the Practical Finance Roadmap into Action |

|

| Common Pitfalls and How to Avoid Them |

|

| Tools, Resources, and Ongoing Growth |

|

Summary

Practical finance roadmap provides a clear, repeatable path from budgeting basics to disciplined investing. This descriptive overview highlights how small, consistent steps—building a budget, creating an emergency fund, paying down debt, saving, and gradually investing—can compound into long-term wealth. By following this roadmap you gain confidence, reduce money stress, and build a financial framework you can adapt as life changes. The emphasis is on practical actions over shortcuts, turning intentions into tangible progress.